Usually, when a company comes to me with more than $2.5M – $3M in net income, I know that company will very likely attract buyers who will view it as a potential portfolio or platform company. These are very fun deals to represent, as they are usually the ones I will receive multiple offers for: in some cases, as many as a dozen or more. My sellers, then, have a plethora of options (sometimes too many) to pick from. This is, in part, because there are not as many technology companies out there who amass that kind of EBITDA value to become a portfolio company.

When a seller receives this many offers, they will have the luxury of looking really hard at the buyers or types of buyers: usually a private equity firm or independent sponsor. And in my experience, I find offers from independent sponsors to be a bit more creative and, many times, more enticing than that from a typical PE firm. While they may look very similar to a newbie seller, they are actually very, very different. And depending on which one you choose, it can extend the deal process by at least 30 – 90 days.

So, what is the difference between an independent sponsor and traditional private equity?

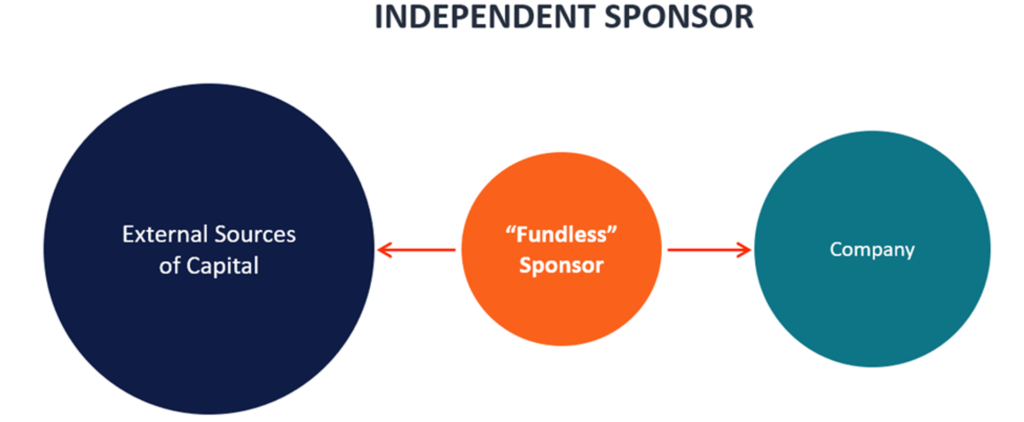

Since most of you read my posts regularly, you already know what a PE firm is. So, let’s jump into what an independent sponsor is. An independent sponsor, also referred to as a fundless sponsor, is an individual or capital group seeking to acquire a company, but who does not have the money (either equity or debt) needed for the transaction in advance. The independent sponsor finds a target company, and then seeks an investor that can provide equity to acquire the company. They leave the day-to-day operations to the CEO and management team, but will receive equity in the company, fees, and distribution of profits at the end of each year.

Commonly, independent sponsors are former private equity experts or investment bankers who want equity ownership and involvement in the growth and operations of a company.

While the two buyers a similar in many ways, the biggest difference between the two is that traditional private equity firms have already raised a pool of committed capital in which they pull to acquire multiple companies. These firms have committed equity capital behind them and can invest in a company without outside approval from investors. Once the portfolio company is acquired, a private equity firm is involved in many aspects of the business, but does not typically take control of day-to-day operations.

Similar to a PE group, an independent sponsor generally does not take on the day-to-day operations of a company. Independent sponsors come in all ranges and sizes; some have incredible relationships with family offices and private equity and have the ability to quickly close deals, while others do not. More on this shortly.

As we mentioned above, independent sponsors are fundless sponsors who raise funds on a deal-by-deal basis. This means that they cannot begin the process of looking for or raising money until they have a signed LOI. Yes, you read that right.

And while they have laid out some nice terms for you in the LOI, they ultimately don’t have control over the final terms of the deal; the investor(s) do.

So, then, who would ever sign an offer with an independent sponsor if they don’t have money to buy you? And therein lies the rub. Do you take a higher offer from an independent sponsor in the hopes that they can raise the money or provide a term sheet to back up that offer, or do you go with the sure bet of a PE firm who already has assets under management? It really depends on how big the difference is in the offers and how risk adverse (or not) your seller is.

How to pick a good independent sponsor

Having been through a few of these myself, I can say there are a few things I learned when it comes to picking an independent sponsor – some of which I learned the hard way. As I mentioned earlier, even if they made an incredible offer, they still need to find an investor to back up that offer. And that typically takes 60 – 90 days, depending on how connected your independent sponsor is with the greater investment community.

So, here are my top 5 tips when selecting an independent sponsor:

- Make sure they have a track record already as independent sponsors. Even if they recently left a PE firm, that doesn’t necessarily mean they have the best contacts or the industry experience.

- Make sure they have made an investment in your specific niche or industry. Meaning, if you are an MSP, VAR, or ISV, make sure they have made an investment in one in the past, because they are all very different and attract completely different investors.

- Get a Letter of Interest from one or more of these prospective investors so you know who, specifically, they are eyeballing to fund this deal. And stay away from multiple investors unless there is a lead that all others will follow. Otherwise, you will ultimately be reporting to multiple people, which is never fun.

- Talk to other CEOs about who they have worked with to find out how quickly and easily (or not) they were able to secure funds.

- And finally, if they haven’t put you in front of a potential investor in the first 30 – 45 days after signing an LOI, move on. It shouldn’t take that long, and it means they are struggling to find the right investor. This also means you need to carefully craft your exclusivity period when dealing with an independent sponsor. Don’t just do the carte blanch 90-day exclusivity period without some teeth in it. Your advisor or M&A attorney can help with that.

Finally, and this is probably the most important point: remember, you don’t know yet (as of the signing of the LOI) who the investor will ultimately be. Now, granted, after you meet with them the first time (which is usually required for the independent sponsor to get a term sheet from the investor), you will not likely see them until the close, and then only at board meetings after that. But, if you don’t feel like the investor understands your business, or you just don’t get a positive vibe, let the independent sponsor know how you feel. A good one will try to mitigate issues or potentially switch out the investor. While this will likely add to the time to close the transaction, you want to do this now while you still have the ability to voice a concern. On a positive note, I have found that most independent sponsors not only provide the best offers, but also really understand and focus on a certain niche that they stick to. They typically bring years of experience to the table and can help mentor the CEO by introducing them to other portfolio companies they may have invested in as well. You will get more love and attention from an IS than you will from a PE firm. They will be a great sounding board, act as advisors, and help round up the next tranche of funds for additional acquisitions so you can keep your mind on growing the business.

The Second Bite of the Apple – Why Wouldn’t You Take It?

The Second Bite of the Apple – Why Wouldn’t You Take It?