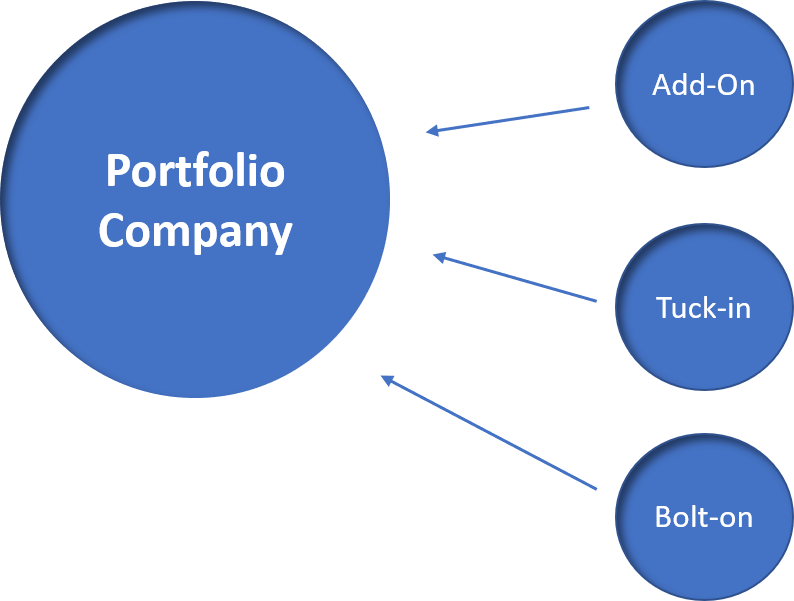

Since there are so many acquisitions happening in our space this year (160+ so far in 2021 as of this article), I thought it would be worth talking about the different types of acquisitions we are seeing in the marketplace with technology service providers. There are mainly four types of acquisitions being made as follows: Platform, Add-on, Tuck-in & Bolt-on

Each of the last three in particular have subtilties that most people are not aware of. In Part I of this post, I am going to focus completely on platform acquisitions. Our next post on types of acquisitions focuses on the other three smaller acquisition types.

The term platform acquisition originates from the private equity world where platform investments are very common. In the context of private equity, a platform acquisition refers to the initial acquisition a private equity group makes to enter an industry with the intent to then “roll up” or acquire other smaller companies in that industry. (1) Strategic buyers don’t really make platform acquisitions, because they are the platform.

When a PE looks to expand into a new geography, new technology or new set of professional services, often the expansion comes in the form of a platform acquisition.

What does a Platform Acquisition Look Like?

Because these companies are effectively acquired as launch platforms, there are certain criteria that buyers look for when seeking out a platform acquisition. Generally, platform acquisitions tend to have the following five characteristics:

- Market Leaders – a platform company tends to be a top player in their respective geographic or functional niche. They may not be the largest players in the industry, but within their sphere of influence they are normally market leaders in terms of sales, brand, client relations, locations etc.

- Experienced Management Team – a platform company tends to have an experienced management team that can continue to manage day to day operations after an acquisition. The retention of senior management and key employees is an important consideration in a platform acquisition. The CEO and other critical team members usually need to remain for at least 3 – 5 years, usually backed by incentives to keep them enticed. PEs look for energetic and passionate managers as this becomes a very busy and fast paced life once additional smaller acquisitions are made.

- Strong Infrastructure and Operating Procedures – a platform company needs strong procedures to run their daily activities and to easily integrate tuck-in or bolt-on acquisitions down the road. This means solid accounting, human resources, marketing automation, CRM and ticketing applications to run the business.

- Multiple locations – in some cases you will see portfolio companies have multiple locations allowing them to better service their clients geographically; both locally and internationally, not an absolute requirement, but more likely than not.

- Revenue – There is no hard and fast rule on this. However, most portfolio companies are north of $25M in revenue and $5M in EBITDA if not higher.

Find out Why you might want a Quality of Earnings Report

How is a platform acquisition different from other acquisitions?

Perhaps the most defining characteristic of a platform acquisition is the valuation of the business. Because platform companies are often considered leaders in a geography, with established operating procedures and infrastructure and an experienced management team, there is often a substantial increase in price that a buyer is willing to pay.

While the platform acquisition may be a higher cost acquisition, buyers often average down the total cost to enter the market by pursuing “add-on” acquisitions later. (More on this in Part II next week.) These smaller acquisitions can be completed at a much lower relative cost. This is often referred to as a “roll up” strategy, where an initial premium is paid to acquire a platform, and then subsequent smaller lower cost acquisitions are made.

Owners of platform companies also see the highest rewards on the ultimate sale of this roll-up down the road. This is really where the money can be made, often more than the initial proceeds on the transaction, but they usually take 4 – 6 years to see that come to fruition. However, with the magnitude and fervor of the technology sector, this timeline can be as little as 3 – 5 years.

Find out How long a typical M&A transaction takes

Conclusion

One of the best ways to increase your multiple is to become a platform acquisition target. You don’t have to be the biggest or best in the industry – just in your area of influence. If staying for the duration is not your idea of fun, be upfront about your timeline to exit and be sure to have a second in command who can take over. If you plan on staying, be prepared to work hard and remain for at least 4 – 5 years to reap those rewards. I am sure it will be worth it.

In Part II of this article, we explore Add-on, Tuck-in and Bolt-on acquisitions – the majority of acquisitions made within the technology service provider industry. Yes, there is a difference between them.

(1) https://www.divestopedia.com/what-is-platform-acquisition/2/8168

4 Risky Types of High Concentration in Business | Avoiding Overconcentration Part 2

4 Risky Types of High Concentration in Business | Avoiding Overconcentration Part 2