In our previous post we explained what a platform acquisition is and how they are different from other acquisitions. As a refresher, a platform acquisition refers to the initial acquisition a private equity group makes to enter into an industry with the intent to then “roll up” or acquire other smaller companies in that industry.

Most companies are not candidates for platform acquisitions, as either their revenue/ EBITDA is too small, or they don’t have the robust management team or internal processes to handle other acquisitions along the way. We typically see platform acquisitions with revenue in excess of $25M and EBITDA in excess of $5M to really be attractive to a private equity group.

That said, the majority of acquisitions today (and last year) for technology service providers have been either tuck-in or bolt-on acquisitions. More on those in a minute. But what about an Add-on acquisition? This is another term we hear a lot, and it has its own nuances.

What is an Add-on Acquisition?

An add-on acquisition refers to a company that is added by a private equity firm to one of its platform companies, or by a strategic buyer pursuing a consolidation investment strategy. The add-on acquisition typically provides complimentary services, technology, or expansion into a specific geography. Add-ons can also provide diversification within products or services that don’t exist in the platform company. For example, a traditional software development firm might purchase a CRM consulting firm. While they both provide consulting, the CRM firm may have specific product experience. Sometimes the term “add-on company” is also used to refer to acquisitions of smaller companies with very little financial and administrative infrastructure, but can also mean larger companies, so it tends to be a very generically used term.

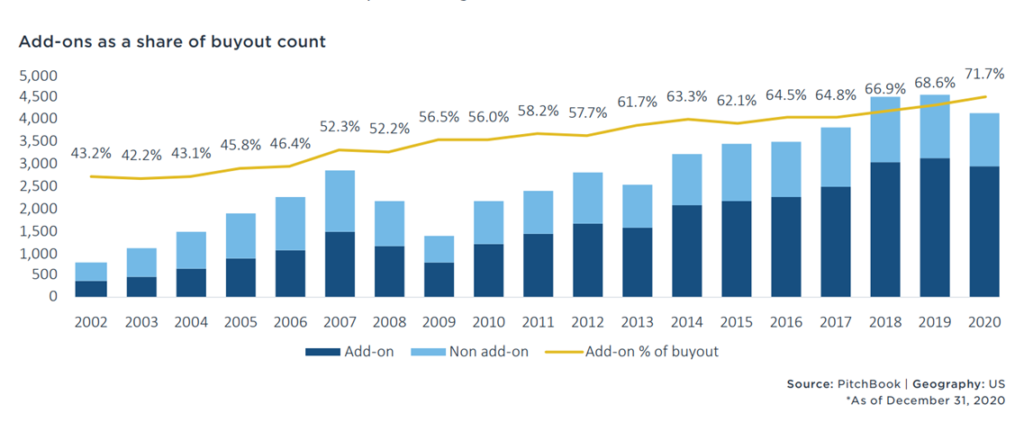

Add-on acquisitions have been increasing in popularity since the early 2000s. As you can see in the graph below, about 72% of US PE deals in 2020 were add-ons, compared to just 43% in 2002. Although overall PE deal count declined in 2020 because of the COVID-19 pandemic, 2021 will likely show the highest count of add-on deals on record.

These buy-and-build strategies span a wide range of intentions. Some involve large-scale roll-ups in which a platform company in a highly fragmented market space acquires a large number of smaller, often founder-owned companies. Others seek more opportunistic M&A transactions that allow portfolio companies to pursue specific product or operational goals. (1)

What is a Tuck-in acquisition?

A tuck-in acquisition is usually a smaller company with very little infrastructure or little to no management team. They are typically run by the owners and have probably reached their pinnacle in terms of revenue and/or geographic expansion due to lack of capital or management expertise. There is no exact revenue range for a bolt-on company. hey can be as small as $1M or as large as $30M depending on how large the platform company is. The acquisition of a tuck-in is usually purely for revenue or geography reasons rather than strategic reasons. However, the larger your geographic reach and the more products and services you support, the higher the multiple. Most of the recent tuck-in acquisitions we see are larger MSPs buying smaller MSPs. You see both PE and strategic buyers buying tuck-ins, so there is a lot of activity.

What is a Bolt-on Acquisition?

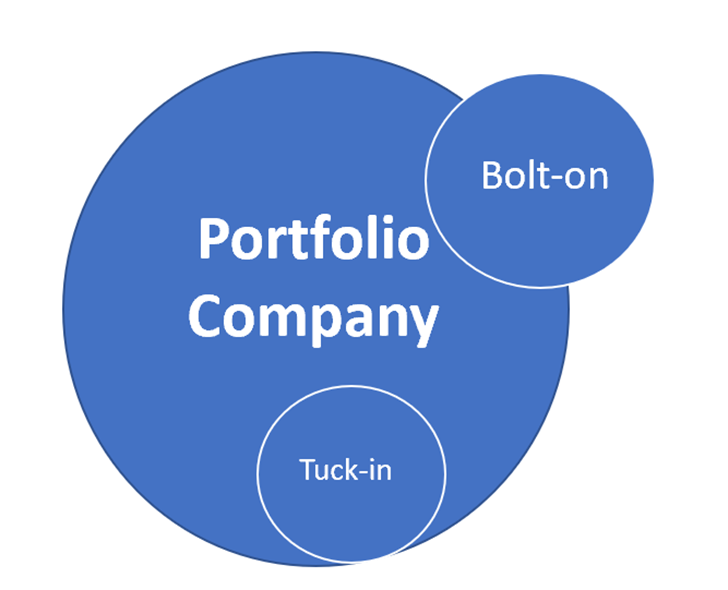

A bolt-on acquisition refers to a company that is acquired by a platform company that is usually backed by private equity. Like a tuck-in, bolt-ons are smaller and lack some of the infrastructure that the larger platform company can provide. But, they are still large enough that they could maintain some of their own infrastructure. For example: Let’s say that a large ERP consulting firm purchases a smaller MSP. The acquisition of a bolt-on is mostly for strategic reasons, and not necessarily just for the revenue. The accounting and HR systems of the MSP may get folded into the larger ERP firm, but the MSP may maintain its own ticketing system and customer support application separate from the platform company. This is common with bolt-on acquisitions.

Typically, you also see a bolt-on company keep their identity. So, the main difference between the bolt-on and a tuck-in is that a tuck-in is completely absorbed into the platform company but a bolt-on may retain its name, individual identity and some of its infrastructure. A tuck-in typically loses its identity entirely and folds all of its infrastructure into the platform company. While a bolt-on may remain small, it usually receives a higher valuation than a tuck-in.

Why are there so many Bolt-on and Tuck-in Acquisitions?

In the last few years, we have seen the amount of these types of acquisitions increase dramatically. The benefits of both of these types of acquisitions are much greater than the risks, and, over time, the compounding effect of adding so many value-generating entities is that the acquirer’s value increases faster than growing organically. Other benefits include:

- Addition of human capital, which is in short supply.

- Smaller companies are cheaper.

- Allows for geographic expansion.

- They are much easier to integrate into the larger companies.

Conclusion

Both tuck-in, bolt-on and add-on acquisitions offer a proven, quick method for companies to add value over time, and it allows the buyer to grow at a rate above and beyond what would be possible organically. Determining weather you are one or the other will partly depend on your size, management team and infrastructure. Geography also plays a role. Remember, the larger you become, the more diverse your customer base, and the more employees you maintain all count toward your value as a company. To learn about the leading eight value drivers to maximize company value, be sure to pick up your copy of Get Acquired for Millions. A must read for both buyers and sellers.

- PitchBook: Exploring Trends in Add-On Acquisitions US PE sees the buy-and-build escalate, innovate, and sophisticate

What is a Platform Acquisition? | Types of Acquisitions Part I

What is a Platform Acquisition? | Types of Acquisitions Part I