Last year, I wrote a blog post on my top 10 tips for creating a projection/forecast, which also included four of my biggest pet peeves when I see a forecast or set of projections for the year.

That said, I have also come to learn that most of you who are under $5M or even $7M in revenue don’t create projections at all. And hey, I get it. Who is going to look at them, other than you, right? Well, I am going to try to change your mind on that, especially if you do plan on selling in the next 24 months! Why 24 months? Because a buyer will want to see not only the current year’s projections and forecast, but they will also want to see how well you performed against last year’s projections!

So, what this means is that you need two years of projections (one for the year you are selling in, and one for the previous year). Oh snap! (I can hear it now, “What projections you say?”)

Here is another big surprise: almost every buyer will want a set of projections for the current year, whether you are mostly recurring revenue or not. Plus, if you are largely project based, they will most definitely want a set of projections for the rest of the year since your revenue will be less predictable year-over-year.

But let’s first understand the difference between a forecast and a projection, because they are used interchangeably and many people mix them up.

Financial Forecast vs. Projection… In a Nutshell

Even among seasoned financial professionals who generally should know better, the terms “financial forecast” and “financial projection” are often used interchangeably.

Projections outline financial outcomes based on what might possibly happen (theory). Therefore, you are likely to have multiple projections (say a high, a medium and a worst-case scenario).

Whereas forecasts describe financial outcomes based on what you expect will actually happen given current conditions, plans, and intentions. This typically means you are combining actuals with the set of projections you decided to go with. This also means you only have ONE forecast.

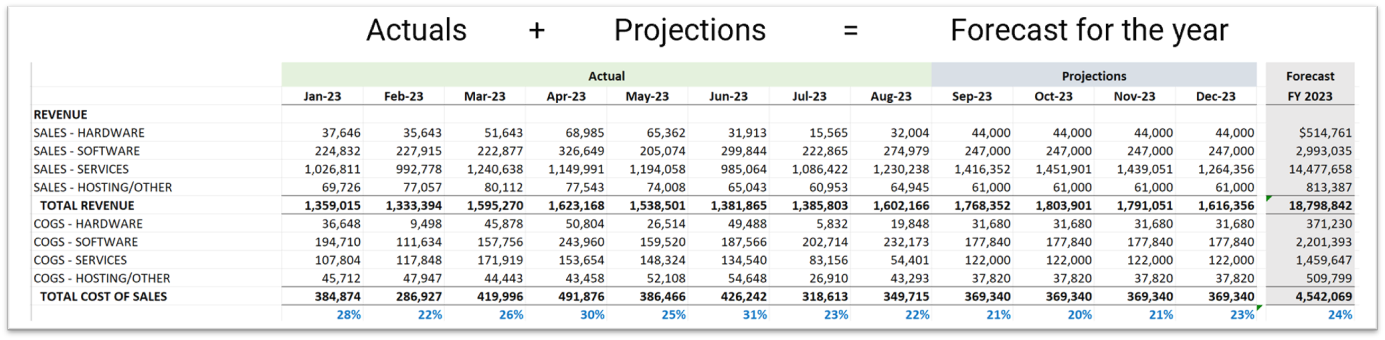

Here is a good visual for just the revenue and cost of sales sections of your P&L. Notice how we have actuals through August and projections for the rest of the year to come up with the “Forecast” for the end of the year.

10 Tips to Create a Quick & Easy Forecast

Look, I get it. No one wants to have to create a projection or forecast from scratch, so I thought it would be good to give you my tips on how to create a quick and easy forecast that even a non-accountant can do easily. Let’s get started:

Step 1: Print out in column detail the last year’s twelve months (January through December if you are calendar, or use your fiscal year if you have a different year end). Make sure you drop the data into a spreadsheet, such as MSExcel, with all its calculations – this is key. Most every accounting system will allow you to do this.

Step 2: As I show up above in blue color, calculate the following as a percentage of TOTAL REVENUE:

- Cost of Goods Sold section (cost of goods sold/revenue)

- Gross Profit Margin (gross profit/total revenue)

- Sales and Marketing as a percentage of revenue – if you break that out

- General and Administrative expenses as a percentage of revenue

- Net Income before taxes as a percentage of revenue

List these in a row below each one of these numbers so you can easily see any changes across the row.

Step 3: Notice if there are any changes or fluctuations in these percentages between months. If you are on the accrual basis, this should be easier to see. If you are cash basis, you might have some large expenses or sales that may sway these percentages. But either way, you should see an overall pattern. Investigate any large variances between months.

Step 4: Calculate your YOY (year-over-year) growth in revenue for the last two years. That way, you can see how much or how little growth you have seen in revenue over the last couple of years (or maybe you’ll even see a decline). To get this number, calculate: (this year revenue minus last year’s revenue/last year’s revenue)

Step 5: Calculate the same YOY number for net income (without taxes) – use the same calc as above but for net income.

Now you have a good idea, on average, of how much your company grows both top-line and bottom-line net income. Now here comes your first decision: how much do you think you will grow in revenue for the year? Base that on the last two years. For example, if you have grown, on average, 15% over the last two years, it would be a fair assumption that you will grow that much this year, or more if you added a salesperson, etc.

Step 6: In Excel or your spreadsheet of choice, create one year end column at the end. Then, take the last twelve months, add them up, and apply your growth rate across each row, down to the bottom of the page. Now that you have your entire P&L increased by whatever percentage you said you would grow, you need to look to see if all your costs will increase or if you have capacity amongst your admin areas and even your people costs. Maybe you don’t have to increase general and administrative expenses like rent, utilities, insurance, or things that are generally fixed in nature. This is where the real increase in the bottom line will come into play. You may also not have to increase your sales or marketing expenses if you don’t need to add people to the team. But do review other marketing costs like SEO or other expenses if you need to increase marketing to increase sales. And do increase your rent if there is a mandatory 3% or so increase per your lease.

Step 7: Examine your labor costs. Depending on whether your labor is up in your cost of sales section or below, you will really need to determine if your percentage increase will account for extra increases in wages, benefits, etc. If you need to hire additional personnel, then you will need to adjust your labor costs accordingly (which should also include an increase in payroll taxes and benefits to bring on new team members).

Step 8: Now that you have reviewed all your costs and adjusted up or down, accordingly, by line item, you need to review your revenue for the last twelve months and decide if it is distributed evenly or if you have some months where revenue is greater than others. Many VARs still have a lot of cyclical changes in their revenue, where months like December and June are very high, but the months afterwards may not be. However, most of my MSP clients have very predictable monthly revenue. If your revenue varies, then you need to do one more calculation. Compare last year’s revenue by month to total revenue for the year to get revenue by month as a percentage. Then, when you go to allocate your revenue and cost of sales out by month from the total new projected revenue and expenses for the year, you now know how to allocate each month.

For those of you who have equal revenue each month, you can probably take the new revenue and expenses you projected for the year, divide both by 12, and allocate them evenly over the year. Sure, this won’t account for increases each month, but in the end, you should hit the final projected numbers. Or you can take your last month’s actual revenue amount and increase by a percentage each month. So, say you are expecting 12% growth for the year, then each month your revenue should grow by 1%.

Step 9: Now that you have allocated your revenue and expenses out by month (either evenly or by a percentage based on last year’s sales), step back and look at each line item to see if it makes sense. And look for new revenue and expenses that may not have existed last year (e.g., conference expenses for the upcoming year that you didn’t attend last year, or a holiday party that is back that you didn’t have last year, or extra bonuses you might be paying that you didn’t pay last year, etc.)

Step 10: Cross check your work and tidy up by doing the following:

- Check all rows against columns for accuracy, meaning total each month and then total each row and match at the end.

- Eliminate all cents; no one needs cents. It’s just stress on the eyes.

- If sharing a forecast, add your closed months to the remaining months of your projections to get a forecasted year end as we showed above. If showing actuals with projections, show the actuals in a different color than projections so it is easy to read.

- Use dollars signs at the top and bottom of each row and always turn on the commas so they show up in the right place for numbers greater than 999 dollars.

Now, I know anyone who is an accountant in a former life is probably going to cringe a little at these steps, but at least it will give you a much better answer than just raising your thumb in the air and dropping some number down on an Excel sheet. This method will be based on historical growth numbers and will be detailed down to the line item in the P&L. Plus, it will be realistic. I hope you find this helpful.

Independent Sponsors vs. Private Equity: What’s the Difference and How Do You Pick?

Independent Sponsors vs. Private Equity: What’s the Difference and How Do You Pick?