It’s no secret that, as part of getting ready to sell your company, you need to have a solid set of financials which includes not only a balance sheet and income statement, but also a set of projections. Projections, especially, are a critical step in the selling process and a key component to helping the prospective buyer see what your company has planned for the remainder of the year and beyond. Remember, buyers don’t buy the past, they buy the future. So as proud as you are of your performance this year, it will be water under the bridge once the year is closed.

Your future and your story are in your projections. Remember, these are your projections without the potential upside of a sale. This should be a picture of how your company will grow without any help from a prospective buyer. So, as a recovering accountant and viewer of many of my clients attempts at projections, let me share with you my best tips for creating yours (and some of my pet peeves as well).

Let me start out by saying you absolutely need to have projections, not only for the remainder of the current year, but next year as well. You are never too small to create projections nor are you too successful. It is just a necessity of selling your company, so here are my top tips when creating yours, plus one big bonus tip for you at the end. Let’s get started

Top 10 Tips for Creating Projections:

- It’s November; therefore, you need to have next year’s projections handy. Not doing so indicates or intimates that you are not a planner, which we all know you are. I was certainly guilty of this myself, and sometimes didn’t get mine done until the end of January; but by then, you really have lost the momentum and planning you need for the first quarter. Start now. You won’t regret it in January, and if you are planning to enter the market to sell your company, it is the second thing a buyer will ask for right after your current financials.

- Avoid the hockey stick, especially if you have been historically growing at 15% – 20% year over year. Of course, if you are launching a new product line or there is some other catalyst that is creating such phenomenal growth, then, by all means, show it. But if not, a forecast like that will question your credibility. And if a forecast is unbelievable, then it can turn a perfectly salable business with a great management team into an unsalable business simply because its credibility is killed. Not to mention that it will push most of the terms of any offer to a backend earnout.

- Your forecast should match your financials line by line. If you rollup line items in your financials, you should do the same in your forecast. Now is not the time to be lax and just forecast sales, costs of sales, and a few other line items. Make sure you have supporting schedules for revenue, cost of sales, salaries, and other large items.

- Don’t assume that fixed costs and gross profit margins will NOT change with growth. If you are in a rapid expansion due to a new product, or happen to be in a crazy space like cyber security that is growing by leaps and bounds, neither your fixed costs nor margins will remain the same. Some will go up (fixed costs) and some might come down (gross profit margins). In a growing market, all variable costs such as labor become more expensive. And if your business is growing rapidly, you will likely incur more fixed overhead to support this growth. The overhead may not double, but if you’re forecasting $30 million in revenue, projecting the same fixed overhead that the business incurred when it was doing $10 million in revenue is not realistic.

- If COVID dinged your 2020 and 2021 numbers, be real about adding back new customers for those you might have lost or existing customers who didn’t spend money with you last year. Remember, there might be some pent-up demand there as well

- Create a forecast that you can take to the bank, meaning be aggressive, but not so aggressive that your earnout (now tied to your forecast) is unachievable. There is a fine balance there, so be sensitive to a future earnout, and don’t push out numbers you cannot achieve.

- Create three versions of a forecast: conservative (use last year’s growth), achievable (with higher growth) and a stretch version (greater growth, just still not a hockey stick). The stretch version is, in part, to help craft a story to a future buyer on how becoming a part of their team could actually increase your revenue. There is actually another reason for your conservative version, which I will reveal at the end.

- Don’t stop short of a big number. What I mean here is don’t give me a year-end projection of $19.8M when you could possibly do $20M. Doesn’t $20M look so much better? Or $3M vs $2.8M or $2M vs $1.9M. And guess what: it also anchors that number in your head and, therefore, you are more likely to achieve it.

- Don’t forget about CAPEX costs: the fixed assets that end up on the balance sheet instead of your P&L. If you are in a business that requires assets to grow, be sure you forecast for those as well. Your buyer will want to see that, as well as know where you may currently have capacity. This could be servers for a data room, laptops and desktops for developers and consultants, etc. They cost money, and it needs to be budgeted for regardless of whether it hits the P&L or not.

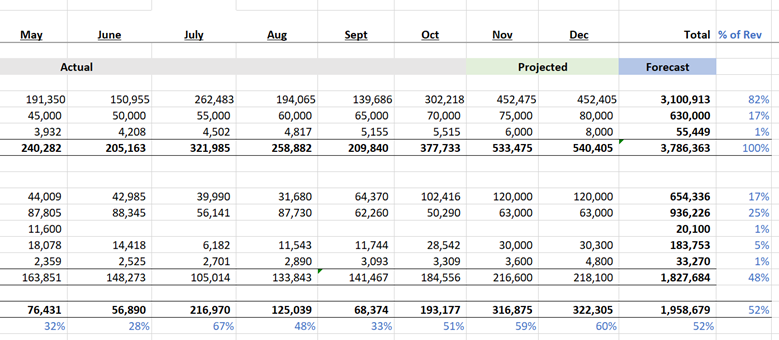

- Finally, use %’s to show costs as a percentage of revenue. Every analyst calculates them, and so should you. I like to put them in blue, so they are highlighted, and it also helps visually to see if maybe you are off somewhere in your calculations. See below for an example:

My Projection Pet Peeves

Ok, now that we have the tips under our belt, let’s talk about a few things you should avoid. Here are a few of my top pet peeves when I see projections crossing my desk/laptop screen as a sell-side technology M&A advisor. I would like to say that I speak on the buyer’s behalf as well on these, so listen up:

- Financial projections are just that: projections. And I don’t know one person who projects down to the cents or even dollars. Spare yourself the detail and keep everything at the 100’s or 1000’s level. No one cares about dollar and cents…at least not here anyway.

- Please do not use dollar signs on every row. It’s just plain distracting. Only use them at the top of rows and at the bottom of rows (like totals).

- Don’t hard code numbers. Even if you are exporting the projections out of your accounting system, make sure it is exported with formulas. It drives analysts crazy because they have to double check everything.

- Finally, please, please, please make sure you double check that rows and columns add up the same when you are summarizing totals (see the example above for the cross check of the 52%). Maybe it is the inner accountant in me, but your projections immediately lose credibility if things don’t add up. I know it sounds obvious, but I see it happen more often than not.

The Bonus Tip

I know this may sound crazy to many of you, but be prepared to show LAST YEAR’S actuals to budget! Wait….. what?! Why? This is asked for by more buyers than you might think, because it is a clear indication of how well your team can create forecasts and budgets. This also tells prospective buyers how credible or reliable the current year’s projections might be!

Finally, they will also want to see a variance report, which indicates line by line why there are differences or large discrepancies between the actuals and forecasts. Hint, this is tip #11. Always update this variance report at the end of each month. Again, no matter how large or small you are, it will highlight what is amiss, either in your budgeting or maybe something you missed in the business.

Alright, so what do you do if you were wildly off? That’s where those three versions of your budget come into the picture (I told you they would come in handy). Pick the one that most accurately reflects the year and roll with it! See, you are already a pro at this!

Want to learn more about getting ready to sell, or have a potential interested buyer? Get on my wait list for my upcoming course, READY… SET…. SELL, an online minicourse for business owners to better understand, plan, and prepare their company for an M&A transaction, so that they can sell confidently to their ideal buyer at the highest potential value.

Recap of M&A Panel at NexGen 2021: How MSPs Should Navigate the Red-Hot Mergers and Acquisitions Market

Recap of M&A Panel at NexGen 2021: How MSPs Should Navigate the Red-Hot Mergers and Acquisitions Market