Happy New Year! To ring in the year, I’d like to start with our predictions for the upcoming 2022 M&A market for technology service providers. Our predictions for last year were spot on and I think I will be right about these as well.

So, if you decided to sit out last year and are now thinking about selling, you haven’t missed out. It looks like the biggest mergers and acquisitions boom in history isn’t showing signs of slowing.

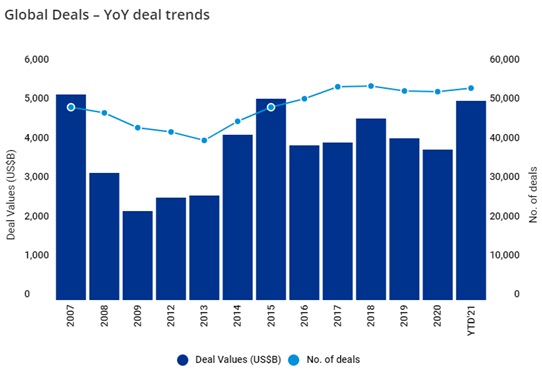

Overall, across all industries, companies announced a mammoth $5 trillion-plus of deals in 2021, according to data compiled by Bloomberg. This eclipses the previous annual record set in 2007 by almost $1 trillion, thanks to wave after wave of transformational M&A right up until the holidays. For more reference, that’s up from $3.8 trillion in 2020, and is the highest level since 2015!

In general, PE deal activity will continue to move at a scorching pace, which also includes Strategic buyers backed by private equity.

According to Pitchbook’s 2022 US Private Equity Outlook report, they predict PE firms will close at least 400 middle-market software deals in 2022. Companies that provide much-needed data integration and multichannel services—and cloud-based software in particular—are receiving increased attention. For the middle market, cloud systems are an effective way to integrate data silos with lower costs than on-site systems that could need additional hardware or internal IT maintenance efforts. Financial software also has opportunities for consolidation, as small businesses are investing more into finance and accounting and stand to gain considerably from modern and efficient functionality, analytics, and automation. For the first time, we are also seeing PE outbidding Strategic buyers.

So, what else will continue to fuel the growth in 2022?

- A widespread labor shortage will continue to push deal-making next year. Let’s face it, we are all looking to hire and cannot seem to find people to fill open positions.

- Interest rates remaining low even though the Fed has suggested three interest rate hikes next year.

- Democrats still grappling over capital gain hikes and increased ordinary gain rates. As long as capital gains rates stay where they are, it will continue to increase the desire for sellers to exit.

But does this mean a frothy market for everyone? Well, not exactly in my opinion.

I believe smaller partners (under 500K in EBITDA) will still see multiples remain generally the same: meaning no dramatic increase. Sellers will continue to seek interested buyers, but with a continued emphasis on earnouts to reduce risk.

Larger sellers (over $10M in revenue and $2M+ in EBITDA) will see the greater increases from this upcoming market. Buyers prefer to work larger deals; after all, it takes the same amount of effort regardless of size. And there are fewer larger partners out there, so when one does come to market, it drives up multiples.

Whether you are interested in selling this year or in the future, here are a few tips for 2022:

- Speak discretely to anyone who reaches out; you just never know, and even if not just for the education of it.

- Don’t anchor on one seller – unless it has been your goal all along to sell to that buyer.

- Continue to manage the customer concentration. Remember, we don’t want one or two large customers and don’t forget to watch for churn.

- If you are planning on selling this year, don’t invest more in marketing unless you are going to be a portfolio company for a PE group. Marketing is always the first group to go if you are a tuck-in or add-on acquisition. Instead, arm your salespeople with resources you already have and incent them to kill it this year.

As always, let’s stay connected in 2021 and see how I fare with my predictions. Have a great year, and looking forward to seeing you at a conference again soon!

Finally, if you want to be a part of my founding class of Ready… Set…SELL!, be sure to register for the waitlist here.

Top 10 Tips: How to Create Financial Projections or Forecasts

Top 10 Tips: How to Create Financial Projections or Forecasts