Even though there is so much uncertainty in the world these days (elections, wars, natural disasters), it has certainly not dampened the M&A scene in the US or Canada. My email (and yours) is still flooded with money (PE firms) looking for a place to invest. It is obvious that the technology service industry is still a hot bed for mergers and acquisitions, regardless of what is happening in the world today.

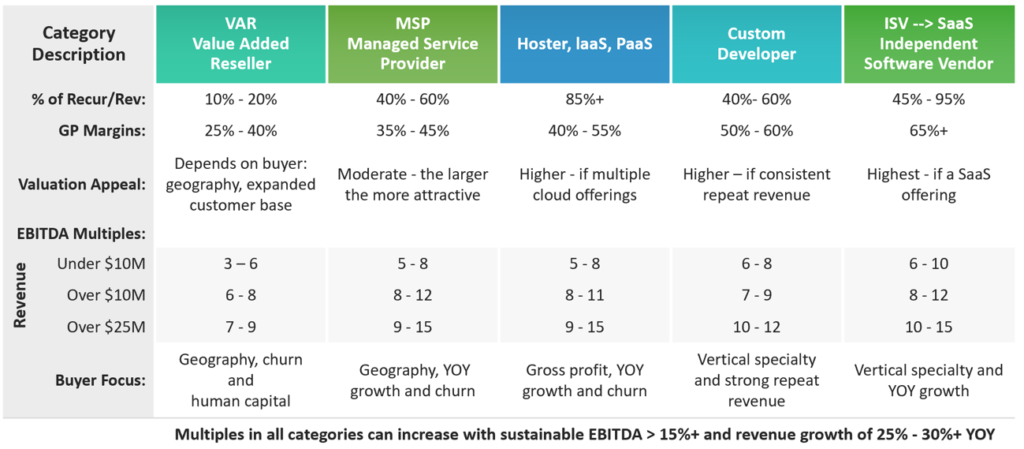

That said, what has also become very obvious is that there is a big gap between what a VAR can expect to receive for their company versus an MSP or MSSP, which is shown in the chart below in the EBITDA multiples section. The latter always receives a higher offer.

This year, I have an equal number of technology VARs and MSPs who are looking for a buyer. While they all range in size and revenue, the EBITDA multiple will vary even more so.

Let me explain with an example: let’s compare two IT service providers (a VAR and an MSP), both with basically the same EBITDA value – let’s use $800K. And let’s also assume that both have over 40% in recurring revenue and have no one single customer representing more than 10% of total sales. The EBITDA multiples for the VAR might range from 4x to 6x, whereas the EBITDA multiples for the MSP will range from 6x to 8x! That’s a difference, easily, of a 2x multiple (2 x $800K) or $1.6M, if not more.

Why is an MSP More Valuable Than a VAR if They are Virtually the Same?

VARs are usually selling the products of one or maybe two large vendors, like Microsoft, Sage, SalesForce, NetSuite, SAP, etc. And while their product or SaaS sales (per seat) are much larger than that of an MSP, they are at the whim of the vendor for their margins, which can be adjusted as much as twice a year based upon new logos or revenue in the preceding 6 months.

This makes buyers, especially PE firms, very uncomfortable as they cannot forecast as well. Plus, some vendors are notorious for changing their margin structures with their partners. So, what might be a 40% margin today could be 25% tomorrow on renewals. That’s a huge drop, especially if your recurring revenue is based on annual renewals.

Also, the software price of most large vendors is publicly posted, meaning everyone, including the prospective customer, knows what the software list price is. So, it becomes very competitive, with many VARs discounting in order to get the deal and hoping they can make it up in services. MSPs, on the other hand, bundle their price around multiple software solutions, which includes labor. Therefore, the price is more of a mystery. And once the system is installed, the labor component of the price continues. With VARs, labor is almost always stated separately. So, once the implementation is completed, the service revenue typically ceases.

VARs, as mentioned above, typically have the majority of their revenue still tied up in a services line. That could be initial services or annual technical support plans, neither of which can be counted on for more than a year. Alternatively, most MSPs either have three-year contracts with their customers or one-year contracts that are evergreen, meaning they will renew automatically at the same price or higher. This is clearly more attractive to a buyer, as it can be counted on year after year, whereas a VAR typically has to either sell more one-off services or more software to increase service revenue after the initial sale.

How all this ends up showing up on financials is also interesting. Most VARs are in the low double-digits as a percentage of net income to sales, whereas many MSPs are above 25% for the same calculation. I routinely see MSPs with $5M in revenue producing close to $1M in adjusted net income. In comparison, it would take at least $8M or more in revenue for a VAR to show the same adjusted net income.

Finally, there is yet one more factor increasing MSP values over that of VAR partners. For the above stated reasons, PE is still investing heavily in MSPs over VARs, causing multiples to escalate at a faster pace due to supply and demand. A solid MSP can easily receive 6 to 8 offers, while a VAR usually doesn’t see that same kind of volume unless they have some very solid gross profit margins due to intellectual property they have created.

In the last 12 to 18 months, I have seen an uptick in PE interest for VARs. This is, in part, because they may have already made a substantial investment in an MSP platform company and are now looking to tuck VARs into the MSP for additional upsell/cross-sell opportunities. But I think this is still in its infancy compared to the continued demand for MSPs by PE firms and other MSPs looking to roll-up in advance of seeking outside funding.

How Can VARs Catch Up to MSP Multiples?

Larger VARs are now starting not only to diversify across multiple large vendor solutions, but they are also looking to acquire or start MSP practices as well. Since they already have a captive audience with their primary offering, why not just add services to an existing customer base? It’s a natural and strategic next step. This, however, is really only feasible once a VAR reaches close to $10M in annual revenue, as bringing on another large vendor solution can be a disruption in billing and could potentially require a whole new skillset or set of individuals to sell and deploy these new services. But I am seeing it in my larger VAR clients, and it will pay off. Do I think VARs will ultimately catch up with MSPs in EBITDA multiples? Probably not, unless they have either developed their own IP and/or diversified across multiple vendors with multiple services. But those partners are guaranteed multiple offers, which then allows for some competition amongst buyers, which ultimately increases the offer…what I live for as a sell-side M&A advisor.

Make sure you read my post about how to choose between 12 offers – and, surprise, it was a VAR – not an MSP!

5 Tips to Keep a Company Sale a Secret

5 Tips to Keep a Company Sale a Secret