Every so often I get pulled into a transaction once a Letter of Intent (LOI) has been received, or even after one has been signed. It is usually at this point that the seller realizes they might want some guidance via an M&A advisor on how best to proceed (in the case of a signed LOI). Or they need help to negotiate the one in hand, or possibly look for other offers with the help of an advisor (I have been pulled into three of these in the last month).

And usually, in each case, the sellers:

All have growing IT businesses, but under $10M in revenue.

All have year over year double-digit growth.

And all have double-digit net income percentages.

The offers I have recently seen for these MSPs were are all around similar multiples of 6x – 8x. One offer was pretty much all cash. A second was a combination of cash and equity. And the third had everything under the sun baked into the terms: cash, equity, a seller note, earn-out, and a bonus at the end of year two.

There is no question that private equity has come down market and is looking either at new portfolio companies to invest in or smaller tuck-in’s to acquire into their existing platform companies. I see them in almost every IT deal I represent. As you probably read in my last article, interest rates and the economy have had virtually no effect on EBITDA multiples for good IT companies and technology service providers. So, if that is the case, why would you ever take an offer that didn’t consist of some equity roll?

I can only think of a few:

- You have been diagnosed with a horrible disease and you only have months to live. Ok, I get that a full cash offer here is probably the right choice.

- You just want to be done with it all – meaning no desire to stick around beyond a couple of months – so an earn-out or equity is just not appealing (I am going to come back to this one).

- The PE firm providing the equity is new or has no track record of exiting a company. There, I might take pause, but only if no one on the PE team has ANY experience.

- And, well, I guess there is a fourth: you sell to someone who doesn’t have equity to give.

So, back to my three sellers. All were perfect candidates for a tuck-in sale to a larger portfolio company, meaning each should have an opportunity to take equity in the new company as part of the deal terms. And since none of the buyers were pure strategics (similar companies/competitors, not back by PE), then it would seem reasonable to assume that an equity roll-over would be available.

But that wasn’t the case.

Some portfolio companies don’t like to give equity. Others may be close to selling their portfolio and may not have any left to offer up (unlikely, but I have heard that story before). Others won’t give you equity unless it is pared with the same amount of seller financing. So, my point here is, even if you have received an all-cash offer or an offer with just cash and earn-out, I WOULD ASK FOR EQUITY. And if none is available, start looking for an offer that does, because they are out there. You just need to look and ask.

Why You Should Consider Rolling Equity

Let me step back for a moment and explain why you would want to “roll some equity” in the portfolio company:

- It allows you to potentially double, if not quadruple, your investment in usually less than 5 years. Not a bad return.

- You actually don’t need to stick around to earn it. Yes, you heard that right – addressing my second point above. Sure, the portfolio company would like the owners who are selling to remain. But if you have a good second-in-command, there is nothing that says you cannot depart after a reasonable transition period. And you still keep the equity.

- You might have yet a third opportunity to earn cash. First was cash at close; second a few years later at the second bite. And the third bite is if you kept equity in the deal and the PE firm recapitalizes or sells yet again to another PE firm, which is happening in abundance.

Example Calculation

Let’s put some real numbers around this and see how it might pan out for you.

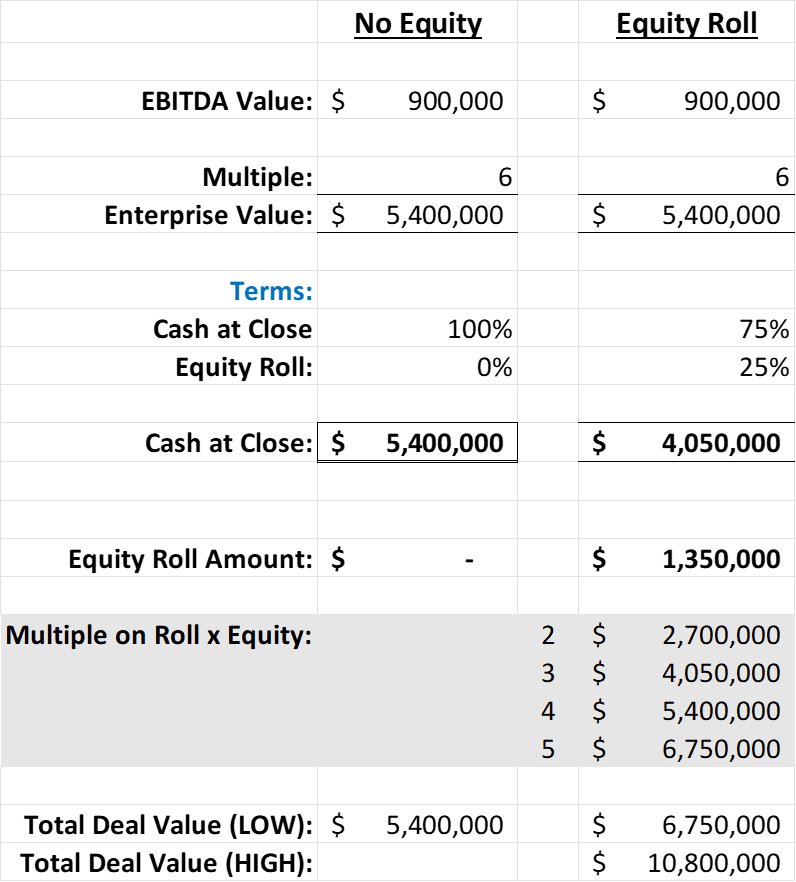

In our examples below, we have a company that generates $900K in adjusted EBITDA. The multiple for the company will be 6x. This multiple gets us to the enterprise value of $5.4M.

In the NO Equity scenario, we can see the terms are for 100% cash at close (I thought we would make this easy, but also an offer we do see for high-recurring-revenue companies). So, the total cash at close is $5.4M.

Now, compare this to the Equity Roll example on the right, where we have the same values as above but, instead, we are rolling 25% of the value into equity of the new portfolio company. So, cash at close is only $4.05M. But there is a second bite years later (usually less than 5) where I laid out values based on the multiple the PE firm could sell for. Now, of course, this also assumes that you buy into shares at $1 per share, which, unless you are one of the first tuck-in’s to that portfolio company, is usually not the case. But those values usually don’t climb drastically over a few years, so even if your price is $2 per share (for the new stock in the portfolio company), you still can make out well.

Some of you may be saying, “Well hey, this is a pretty obvious decision, given that the PE firm can perform well.” And of course, that is always a big unknown. But even if their multiple is dismal on sale down the road and only gets you double your equity roll, that is still a lot better than no equity at all.

Now, in the case where a buyer requires you to take the same amount of seller debt as equity, I would probably negotiate more equity than debt if you can, or find another buyer that is willing. Earning 6% on your money over 3 – 5 years will not likely yield the same results as an equity roll. In fact, the way interest rates are going, you could probably invest that in a CD with a FDIC-backed bank and still make the same money without the risks.

Of course, we all know that selling is not just about the money, but also about finding a good home for your people and your customers, which means a strong cultural fit as well. Can you find all of this and equity? YES, you can, especially in today’s market. And let’s face it, most PE firms would rather give you equity now than cash. To them, rolling equity also means you are in it for the long haul and are committed to the growth of the company. All good things.

So, before you sign that LOI, look at the equity. If there is none, ask. If they answer that there is none, consider another offer. Because I am pretty sure you would rather get $10.8M for your company than $5.4M, right?

M&A Lessons From the Forest Floor

M&A Lessons From the Forest Floor