With summer in full effect, many of us are taking whatever time we can to lounge by the beach, lake, river, or pool to catch up on our reading. Summer is the time to relax, but it is also a time for us to sharpen our minds and think about how to be more strategic in our business. Therefore, whatever reading we do engage in should be quick, easy, and impactful.

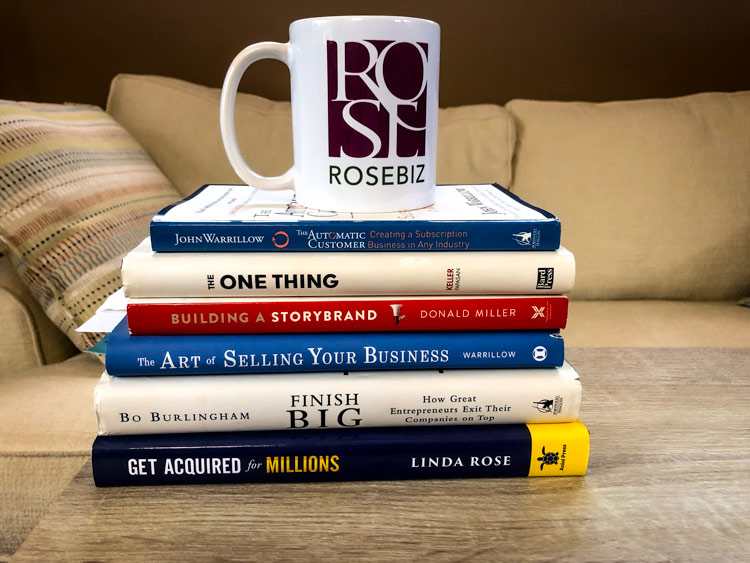

That’s why I compiled a list of my favorite weekend reads and videos focused on growing a business for sale. These all take between 9 minutes and 4 hours to read/listen to/watch, and they each pack a serious punch in terms of useful information on creating a more valuable company.

- Donald Miller Video – Building a website that works

Donald Miller is also the author of Building a Story Brand ( which I highly recommend as well) but I suggest starting with this quick video on creating a website that works.

Whether you have a website that operates well, or know that yours needs some tweaking, you will get inspiration out of this video.

The video gives you tips on:

- Exactly what to place in your hero image

- Creating an aspirational identity

- Where to discuss your customers’ pains

- How to quickly solve their problem

- And where the CONTACT US should really go (hint, not at the top of your website)

Here is the best thing: You don’t need to buy anything, it’s just great free consulting.

I redesigned my entire home page just by listening to the first 9 minutes of this video.

- The Art of Selling Your Business by John Warrillow

This is a perfect weekend book – short, sweet, and to the point, with great tips on navigating a sale.

One of those tips is the 5-20 Rule, which was a new one to me. This rule states that the perfect company to acquire your company will have anywhere between 5x and 20x the revenue of your company.

So, let’s say your business has $5 million in revenue. Using a 5-20 Rule mindset, an acquirer would have revenue of at least $25 million (5x) and no more than $100 million (20x) to be an ideal candidate. The book dives into the reasoning behind this, but it’s a great rule of thumb for identifying ideal buyers.

This is just one example of the many treasures in this book.

You’ll also read about:

- How to figure out YOUR number

- The art of the strip tease – in M&A

- The earnout vs the flameout

And my favorite line in the book:

“A founder who keeps their company beyond a certain point is akin to a parent who cannot let go. There comes a time when your kids need to leave the house in order to reach their potential – and the same is true of your business.” Chapter 17: The Freedom Paradox

- Finish Big: How Great Entrepreneurs Exit Their Companies on Top by Bo Burlingham

What’s the number one reason owners don’t sell their company? They don’t have something to move on to.

While the opportunity to golf, travel and take up hobbies is great, that usually only lasts a short time, and then many former owners find themselves feeling lost without direction and without the work community they’re accustomed to. It’s important to consider your post-sale plan in advance, because once you decide to sell and get an investment banker or M&A advisor involved, the march to close becomes fast and furious.

This book will get you thinking about what is important and what you need to do BEFORE YOU SELL. The author recounts stories of multiple CEO’s who have exited and what they learned as part of that process.

It’s the perfect read if you’re thinking of selling in the next 3-5 years. I wish I had found this book before I sold, but I still learned so much reading it, even after the sale.

Here’s my favorite quote from Finish Big…. mostly because it truly defined me:

“I’ve learned that once you’re an entrepreneur, you are an entrepreneur forever. I still had a yearning to do business. Not that I needed the money. What I needed was to do something meaningful, and to do it for compensation. Giving your time away for free is extremely significant, but I think former business owners also need to feel validated by remaining engaged in the game of business.”

Why do those selling their companies always hit their year-end projections? Time after time, I see sellers have their best year yet…the year they decided to sell. Why is this the case?

They are completely focused on ONE thing: hitting their numbers to get the best multiple for their company.

Normally we get too distracted by the little things in the day-to-day to reach those BIG goals. But if we could just focus on that ONE thing that will get us the results we need, we would have no trouble achieving our lofty goals.

This book teaches you how to do just that: to focus on ONE thing to produce the results you need, whether that is in business, family, personal finances, fitness or spiritual.

It may help you answer one of these questions:

What is the ONE Thing I can do to make the company more profitable?

Or

What is the ONE Thing I can do to increase revenue?

If you can truly answer one of the questions above with just one item, and then put all your focus on it (like those sellers giving it their last all), then you can also achieve your own lofty goals. Trust me – leading up to the sale of my last company, I set one simple weekly goal that added up to millions.

- The Automatic Customer by John Warrillow

I am sure you have heard it multiple times…the valuation for your company increases as recurring revenue increases.

I speak at many conferences, and my most highly-rated session was the topic on increasing company value WITHOUT INCREASING SALES.

Yes, you heard that right. But what if you are struggling with increasing recurring revenue? What if you cannot think of creative ways to out-maneuver your competition with your offerings?

This book may be your answer.

Inside you will find:

- Nine different subscription business models

- The cash suck vs the cash spigot

- The psychology of selling a subscription

- The all-important LTV to CAC metric (You really need to understand how this works)

In addition, he covers the topic of churn and the importance of “onboarding”.

If you’re still searching for the best recurring revenue model, or just struggling to improve your existing model, this book is for you.

I hope you’ll get as much out of these books and videos as I did. Wherever you are in the process of planning or preparing for a sale, I guarantee you can find value in these resources. And where better to increase your knowledge of growing a business for sale than by a beach, lake, river, or pool with a cold beverage in hand.If you found this list interesting or valuable, make sure you sign up for my weekly newsletter. I’m always focused on sharing useful information relating to M&A, maximizing company value, preparing to sell, market trends, and more. You’ll also be the first to hear about free resources, upcoming courses, and more.

2021 Continuing Upward Trend of Add-On Acquisitions

2021 Continuing Upward Trend of Add-On Acquisitions