Every once in a while, I wonder how I can be in my late 50’s and not have known about something relatively important.

For example, I just recently found out that there are more than 10 different types of magnesium, not just one or two as I originally thought. And purchasing the wrong one can really mess you up…meaning you thought you were taking it to help with sleep, but instead find yourself running to the bathroom.

I felt the same surprise when I found out about “family offices”! Wait, what? Who are these guys? And why have I never heard about them as prospective buyers?

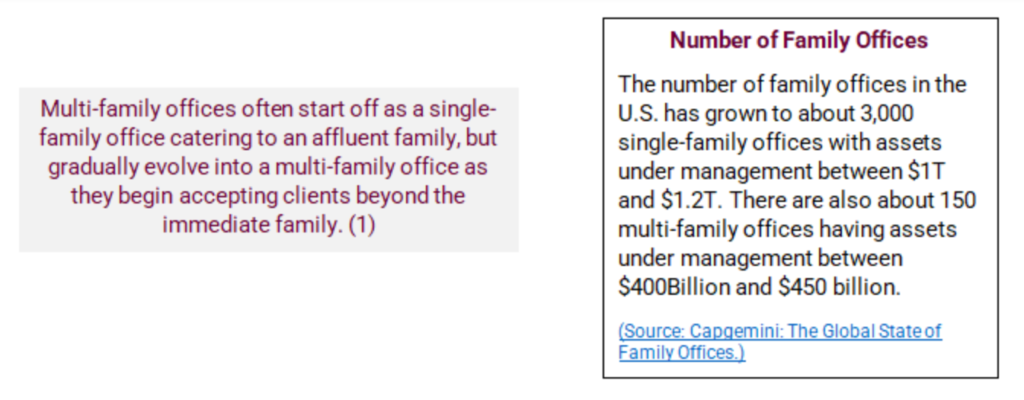

Family offices (FOs) manage the wealth of investors and their families. These high wealth individuals or families invest their own money into companies. They do not raise capital from outside investors. Each office’s sole focus is investing the assets of one family (single-family office or SFO) or sometimes multiple families (multi-family offices or MFOs). You might think of a single-family office as a family run like a business, focused on servicing a wealthy individual’s assets and needs – think Michael Dell. A MFO, in contrast, services many different families and investors like a wealth management firm or private wealth group.

So why is this so important?

The biggest advantage to most family office buyout structures is that, unlike a private equity firm who typically sells a portfolio after 5 – 7 years, a SFO or MFO has no specific hold period. This means they can hold on to investments longer, especially if they are doing well. This lack of pressure to exit prematurely when there is still strong growth within the portfolio or single investment makes for a stronger partnership with the companies they purchase. This aspect is especially appealing to many sellers.

Secondly, it will affect the structure of the deal. Since this is NOT a private equity firm and the goal is not to sell the companies in a short period of time, there is no equity component to the deal. Instead, what I have found with many of the family offices I have worked with, is they tend to make 100% cash offers or offers that have a large component of cash up-front and a smaller earnout over a shorter period.

Many FOs also like to retain the seller and executive team to continue to operate the business with day-to-day control. In this situation, owners are treated more like “senior leaders” than employees post-transaction.

Finally, because FOs have freedom, flexibility and skills to invest across many asset classes, and without pressure of short-term capital cycles, they will invest in add-ons or bolt-ons to their portfolio companies like a traditional private equity group (PEG).

Is there a downside to a Family Office investment?

You bet. Not all family offices are created equal, and the same goes for investment groups. No two family offices are alike: in fact it has been said that, “once you’ve seen one family office, you’ve seen one family office.” So, you really want to be careful with blanket statements regarding this type of fund.

Typically, however, the more money a family office has, the more they can afford to hire talent from investment banks, as well as qualified industry specialists to replace a CEO who is retiring or leaving as part of the transaction.

Still, sometimes a family office makes an investment into an industry they are NOT experts in, buy out the owner entirely with a 100% cash offer, then hire an operator to run the group who has no experience. Unfortunately, I have seen that happen as well. This is a frustrating situation for the remaining management team who has to work under someone’s leadership who really doesn’t understand the business that was acquired.

Conclusion

Like strategic buyers and private equity groups, FOs are currently swimming in cash and looking to make good strategic investments. Many times, they are able to out-bid both PEGs and strategic buyers, while offering a large amount of cash up front. So, if your plan is a 100% cash offer or large cash up front with a short exit runway, then targeting family offices as part of the marketing of your company is key.

As I mentioned in the beginning of this article, I am always amazed at what I don’t know at my age and education. I learned about family offices as part of my last and final company sale. My broker didn’t mention them, nor did he even know that my buyer was a FO until the end.

Like magnesium, I think it is best to be educated on all buyer types, so you know which one fits your persona better as a seller and will present an offer that makes sense for you and your management team.

BTW, you take Magnesium Citrate for constipation and Magnesium Glycinate to help you sleep. Never mix up those two. My personal favorite, however, is Magnesium L-Theonate – it helps with synaptic density which is great for the brain.

- https://www.capgemini.com/wp-content/uploads/2017/07/The_Global_State_of_Family_Offices.pdf

Your Most Profitable Summer Reading List

Your Most Profitable Summer Reading List