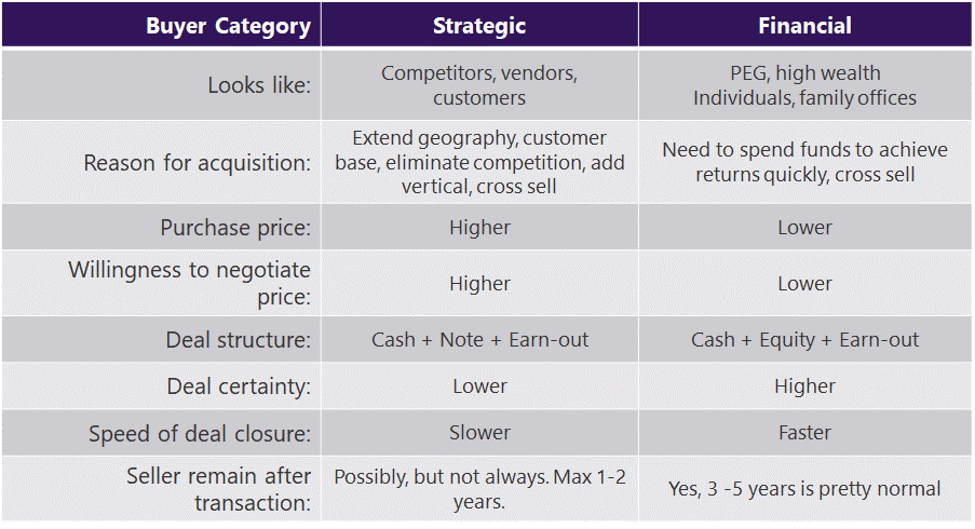

As you contemplate selling your company, understanding the key difference between Strategic and Financial buyers early on can help you determine which buyer is more aligned to your goals and which buyer will best meet your long-term objectives. If you know which buyer you are most aligned with, you can more effectively market your company to that buyer type. Each buyer type does have their nuances and these subtle differences between them can mean big differences when it comes time to getting the deal done. And yes, one buyer type does usually pay more for a company. Read on to learn more…

Strategic Buyer

These are companies that provide products or services similar to yours. They are often competitors, vendors or customers. They might sell a complimentary product or possibly be completely unrelated to your company but looking to grow in your market to diversify their revenue source. A good example of this is CPA firms looking to purchase technology companies where they can cross-sell technology consulting services to their audit and tax clients.

Strategic buyers are looking for companies who can fit into their own long-term business plans. Their interest in acquiring a company could include a vertical expansion (complimentary products/services) a horizontal expansion (geography), eliminating a competitor, or to enhance some of their own weaknesses either in sales, marketing technology or human capital. A strategic buyer will most likely eliminate redundancies specifically in accounting, HR, marketing and even IT. So, for sellers who do not have a strong or deep management team, a strategic buyer may be a good option.

Financial Buyer

These buyers include private equity firms, venture capital firms and family investment offices or high net worth individuals. This buyer type is in the business of making investments in companies and realizing a return on their investment. Financial buyers will carefully review the financials and are more apt to make their buying decisions based on the strength of the financials and management team as well as the future earning and longevity of the products and services they are acquiring. They typically don’t keep a company more than 5 – 7 years before they sell it, unless it’s a family office or private individual in which case that time frame might be longer.

More often than not, financial buyers are not as well versed on the products and services as a strategic buyer would be. Instead they make acquisitions on the expected future earnings of the company and expected cash flow. While financial buyers may see the “potential” for expanding cash flow, they are generally not willing to take the risk or pay for that potential. They are more likely to keep the management team in place, as they don’t know the nuances of your business and thus incentivize the existing management team with equity in the company so they may profit later with the eventual sale of the company.

Need an advisor? Get tips on selecting an M&A Advisor in this blog post »

Which buyer type pays more?

Strategic buyers typically are willing and able to pay more for a company than financial buyers. First, they are able to capitalize on economies of scale, and will plan on removing any redundancies after the acquisition giving them some extra cash to pay the seller. Secondly, since they know the business better than a financial buyer, they can see the opportunities to up-sell and cross-sell existing solutions into the customer base they are purchasing. They will pay more to purchase a vertical they see as synergistic to their own customer base. And finally, they are in it for the long haul, so they are willing to wait a longer period of time to reap the rewards of the acquisition.

Recently, due to the extensive amount of capital sitting on the sidelines that needs to be invested and the flurry of M&A activity, financial buyers have upped the amounts they are willing to pay to remain competitive with strategic buyers. And if the recurring revenue and EBITDA (earnings before interest, taxes, depreciation and amortization) are high (20%+) then they will offer a significant amount of cash up front. Much more than a strategic buyer will. So, don’t assume a financial buyer will always pay less. They may actually offer better terms and a quicker exit.

Which buyer is more likely to get a deal done?

Most financial buyers are in the business of getting deals done and therefore the selling process moves faster. They typically have people dedicated to structuring deals; the due diligence process, contract negotiation and the post integration efforts. Even though a financial buyer may take longer on due diligence and their contracts tend to be a bit lengthier and more robust, they tend to move through each phase of a deal quickly and the probability of closing a transaction is higher. Short of some major obstacles or revenue amounts being overstated, a financial buyer will close a deal within 90 – 120 days of a Letter of Intent, or sooner.

Strategic buyers on the other hand, are typically not in the business of purchasing companies, so it typically takes them longer to get through due-diligence and contracts. They also have a business to run, a board or shareholders they may need to get approval from and other daily distractions that can eat at their time and cause delays. This can drag a deal on and in some cases it stalls out completely. You have heard the expression “time kills all deals” and it is very apropos with this buyer type.

Those strategic buyers that do make multiple acquisitions usually need time in between each in order to integrate into their company the most recent purchase which can slow down future transactions. Although, some strategic buyers have an acquisition team whose sole purpose is to find, negotiate, purchase and integrate companies. These buyers act more like financial buyers and follow a process for developing offers and closing transactions. More on this below.

Which buyer type is right for you?

So now that we understand a little more about each buyer type here are a few scenarios that may describe your situation and the best buyer type for you:

- The seller wants the highest price possible – If your only goal is to get the highest price possible for your company and you are really not as concerned about culture fit or keeping your existing people and facilities in place, then a strategic buyer is the best way to go. Since they typically pay more and may not keep all your employees or even your office, they are your best fit.

- The seller wants a high price but has other concerns – If your goal is to get the high price, but maybe not the highest and you really don’t want to lose your “culture”, your people, and all the infrastructure you have built, then a strategic buyer may work. So might a financial buyer or specifically a family office or high-net worth individual. They might not offer the highest price but will likely keep in place what you have built.

- The seller wants to leave immediately after the sale – If walking out the door within 1 – 6 months is your goal, then a strategic buyer is your most likely option as they understand your business well and may be able to rely on your existing team for the transition. Most financial buyers want the entire management team to remain intact which many times includes the CEO, but not always. A family fund may actually allow you to leave quickly if you have a strong management team in place to pick up your duties.

- The seller wants to cash out but wants to remain for a period of time – This scenario lends itself to a financial buyer more than a strategic. A financial buyer will typically incentivize the management team with equity in the newly purchased business and will want you to remain to help grow the business. A strategic buyer generally has the expertise to operate the business and can save money by eliminating high earning CEO’s. But, if you have a considerable amount of your deal structure tied up in earn-outs, you may want to stay for as long as possible to make sure that earn-out is achieved.

Strategic vs. Financial Overview

When a Strategic “acts” like a Financial and vice versa

As we mentioned above, the strategic buyers who purchase a lot of companies look at acquisitions to boost their top line revenue and earnings and may actually act more like financial buyers. They will have teams in place to quickly negotiate deals and begin the due diligence process like a financial buyer.

Conversely, financial buyers sometimes act like strategic buyers, especially if they have purchased a platform company. (A platform company is a company that a Private Equity Firm uses as a starting point for follow-on acquisitions in the same area). Each additional company they purchase is a “tuck-in” and they will evaluate these tuck-in acquisitions more like a strategic buyer by using the expertise of the existing platform company to make these acquisitions. Then like a strategic, they will eliminate redundancies to achieve economies of scale.

More Resources

Still not sure which buyer is best for you, well then you will want to take the quiz “Who is your ideal buyer type?”

Strategic vs. Financial Buyer

Who is your ideal buyer type?

Another resource to help you learn more about these buyer types, is the chapter in Part I – Driving from a Desire to a Deal, in my book, Get Acquired for Millions. We discuss in depth each buyer type and what specifically they look for in their acquisitions. These two resources should set you on the right path to your ideal buyer.

One of the most lucrative fields at the moment however is that of insurance technology. This is particularly lucrative in this day and age due to the fact that identity theft is on the rise. As more and more people throughout the world turn to online banking the risk of identity theft grows.