Almost every buyer I have been speaking with so far in 2020 anticipates that this year will be yet another strong year for acquisitions. Although with the flurry of acquisitions in the last three years, there are fewer high-quality sellers out on the market. And those that are thinking about selling may be second guessing their timing. Afterall, it seems everyone is upbeat about the economy with no recession in sight. Organic growth is at an all-time high and revenue and profits continue to climb. So why would you want to consider selling now? It seems like the longer you hang on, the higher the company valuation, especially if you continue to grow, right? So why not as the saying goes in French “laissez les bons temps rouler” or my favorite song from the music group The Cars [let the] Good Times Roll.

While predictions for 2020 and 2021 are rosy, no one is really predicting beyond that. The accountant in me knows that we should have had a recession two or three years ago (we normally have one every 10 years in the U.S. and our last one was in 2008, in case you forgot), so we are clearly overdue. So, what does all this mean for someone who “eventually” wants to sell?

Timing is everything

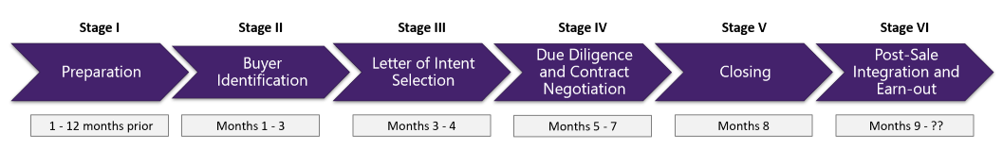

Since none of us has a crystal ball and can tell the future, let’s look at what we do know and how long it takes to sell a company and achieve the earnout. Let’s start with the deal itself. For those who are prepared and ready to go from first deciding on a broker or advisor to actually closing the deal can take anywhere from 8 – 12 months. Here are the six steps in a sale which I explain in detail in Part 1 of my book Get Acquired for Millions. Could it take less than 9 months? Sure, but if you are really looking at multiple buyers, and not just the one that has contacted you, the process typically takes 9 months.

Whether you are selling to a financial or strategic buyer, every deal has at least a couple of the following components as part of the terms: cash, note, earn-out and equity. Ideally, you would love 100% cash up front, but in reality, 95% of the time there is an earn-out component as part of the transaction terms.

The first two deal components are pretty secure (cash + note) and you can count on earning them regardless of the economy. And usually the note has a fixed interest rate or one that fluctuates with prime. The second two (earn-outs and equity) can be dependent on how strong the economy is while you are working through those periods. Meaning if the economy is in a downturn, the probability of achieving 100% of your earn-out is going to be lower. That can also be the case with an equity investment, or your buyer will sit on the equity investment longer, which again given the net present value of your investment, can mean less over time.

Also, the average earn-out period for technology service providers is around 24 months. Yes, some could be as short as one year and others can be as long as three years. But we will stay with averages for our example to illustrate our point. So, if we add the two together, again using averages, we can see that the process from start to finish (when you receive all your cash, except for any deferred equity cash-out) can take an average of three years. That assumes of course, in our timeline above, that you were ready to start the selling process immediately. And for most owners, that is usually not the case.

Most owners, unless they have been working on it diligently, actually need some time to get their finances and company in peak condition. This can mean any of the following:

- Converting from cash or semi-cash accounting to full accrual

- Getting an independent audit or review of your financials

- Making sure all customers are under a current contract or engagement letter

- Finalizing the documentation of any and all intellectual property being used in the business

- Hiring personnel into key positions or filling new positions that will be critical for a smooth post-close transition.

- Integrating key applications within the organization (i.e. CRM to ERP, or Ticketing to Billing)

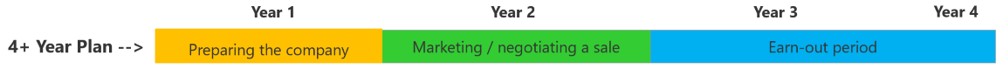

Note: we have seen many companies change accounting, CRM or billing systems in anticipation of selling their company which usually required 12-18 months to successfully complete. Other items listed can take anywhere from 6 months to a couple of years to complete, pushing out your timeline to sell and complete a transaction. Now your timeline to complete the transaction and achieve your earn-out might look more like this:

Once a recession begins, historically we have seen that it takes about two years to come out the back side, which means if you begin your selling process at the beginning of a recession your entire earn-out period could be during the most difficult economic times.

As we mentioned in the beginning of this post, we are all pretty comfortable TODAY with what the economy looks like for the next couple of years, but 3, 4 or 5 years down the road is not so clear. So back to our timeline: if you begin the process now (meaning you don’t need time to prepare your company for a sale), the worst case scenario might be that your final year (should a recession start after 2021) could be the most difficult to achieve an earn-out, but by then, you probably have earned a good amount and may be less stressed about the remaining amount.

If however, your exit strategy is in the next 5 years, keep in mind you will need to wait for a couple of years beyond a recession for everything to come back to today’s values before you will want to sell your company to allow valuations to return to normal. That could put you well beyond the 5-year timeline you have in your mind to exit.

So while it may seem like keeping the company growing and earning more money is the right answer NOW, it may be more profitable and better personal timing to begin the process today and complete the entire cycle and earn your money while life is good….. and let the good times roll.

Not sure if you are personally ready to exit? We have an assessment for that.

Financial vs. Strategic buyers – which one is right for you?

Financial vs. Strategic buyers – which one is right for you?