Reading Time: 5 minutesIt has been over two years since I have written about M&A fees, and I felt it was time for an update. After all, a lot has happened in two years! Here are highlights from M&A fee surveys, and takeaways from my personal experience over the last two years.

Bumps in the Road…. After the Letter of Intent is Signed

Reading Time: 9 minutesGetting a Letter of Intent (LOI) signed with a company or individual you want to sell to is an accomplishment. Unfortunately, there are almost always bumps in the road before a deal is closed at the price and terms specified in the LOI. Here are some of the most common bumps that can appear, and what you can do to mitigate or avoid them.

Bumps in the Road…. After the Letter of Intent is SignedRead More

The Most Common Questions I Get Asked about LOI’s

Reading Time: 7 minutesThe day you receive your first LOI is pretty special. Someone is ready to give you hard, cold cash for your years of effort. Now what? Here are the top questions about LOIs.

The Good and Bad of an IOI

Reading Time: 5 minutesUnderstanding the difference between an IOI and LOI can be difficult for anyone new to M&A. Here are the most common items you MIGHT find in an IOI.

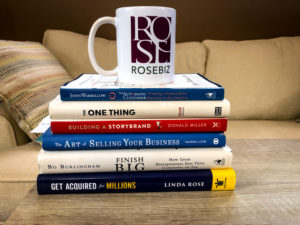

Your Most Profitable Summer Reading List

Reading Time: 5 minutesSummer is the time to relax, but it is also a time for us to sharpen our minds and think about how to be more strategic in our business. Therefore, whatever reading we do engage in should be quick, easy, and impactful.

2021 Continuing Upward Trend of Add-On Acquisitions

Reading Time: 2 minutesAdd-on acquisitions are on the rise, and it doesn’t look like they’re slowing down. If you’re considering selling your small to mid-sized company in the next few years, this is great news.

2021 Continuing Upward Trend of Add-On AcquisitionsRead More

Hiring Your 2iC – aka Second-in-Command

Reading Time: 6 minutesHere is a scenario I see time and time again…. The owner has been running the company successfully for 20+ years and is now thinking about exiting. They share with the prospective buyers that they want to exit shortly after the sale. Buyer response……. Who is your 2iC and can they run the business?

Top 10 Due Diligence Request List for an LOI or IOI

Reading Time: 4 minutesThis due diligence request list will help you understand what documents are required for due diligence and when a buyer is requesting too much info.

Top 10 Due Diligence Request List for an LOI or IOIRead More

Wait or Sell? Capital Gains are Your Answer.

Reading Time: 4 minutesBiden’s proposal for taxing capital gains as ordinary income has the potential to have a huge impact on investors, especially those with a relatively big investment in the stock or bond markets.

4 Risky Types of High Concentration in Business | Avoiding Overconcentration Part 2

Reading Time: 4 minutesThere are forms of concentration such as vendor, geographic, industry and employee concentration that can also affect valuations depending on your size. Let’s take a look at them in detail.

4 Risky Types of High Concentration in Business | Avoiding Overconcentration Part 2Read More