I realize we are a month already into Q2, but Q1 efforts are just now starting to pay off. Therefore, I am a little late in analyzing the results.

Let me be more specific: I am a big fan of going to market early in the year with new deals because, like everything else, M&A also likes to complete purchases and projects by year end. Therefore, I went to market early February with clients I have been preparing since late last year, and the fruits of our labor are just now appearing.

I am currently “in market” with two lower middle market IT projects. One is an ERP/CRM reseller, and the other is an MSP. The earlier one went to market in February and has received an overwhelming number of responses for signed NDA’s (72 to be exact). While the opportunity is a good one by all definitions (YOY growth, gross profit margin, and strong EBITDA values) it is still shocking to see the level of interest by private equity (fully funded PE’s, independent sponsors, and family offices). The ratio of PE to strategic buyers was staggering: 8 to 1.

Maybe this is no surprise, as many advisors like me were anticipating a blockbuster quarter for deals in Q1. But in late January, talks of a potential pause began to be whispered in the halls. Between the massive inflation, increase in interest rates, and the war in Ukraine, which has ushered in an era of global uncertainty and has increased the wait times of every aspect of my home remodel (not to mention the 9 – 12 month wait times for cars due to microchips), global M&A actually did take a hit by nearly a quarter (or 23%), year over year, according to Refinitiv.

But as I started this post, this is NOT what I am seeing. And this week I was validated in my thinking when Axial released their Lower Mid-Market Pursuits article. According to Axial’s LMM article, deal flow remained remarkably steady, portraying a relative calm that contradicts the volatility evident almost everywhere else. At least this was the case in the lower middle market.

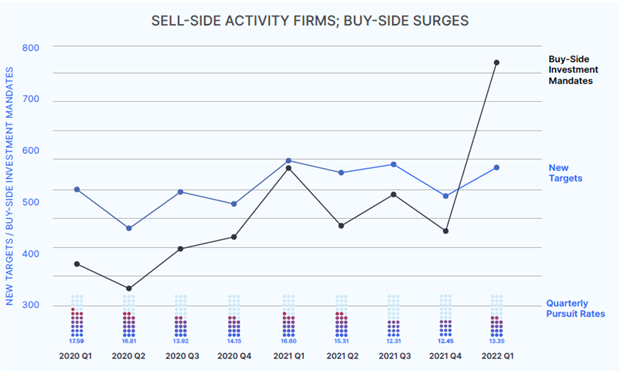

To put it into context, LMM deal flow in Q1 jumped by 10% from the fourth quarter, as new sale processes on the Axial platform* nearly matched the high-water mark set in the first quarter of last year. Buy-side activity also surged, growing by nearly three quarters (72%) sequentially versus Q4 and by a third (33%), year over year.

What does this all mean?

Even with the volatility in the markets (Nasdaq index is down 21% in 2022, it’s the worst start to a year on record), PE and Strategic buyers are finding comfort in the lower mid-market, as these companies remain strong with profitability on the rise. And that means the LMM is maintaining value!

But what I am also seeing is buyers being more cautious and asking more questions about their prospective deals, and offering not only cash up front, earnouts, and equity, but also seller notes to help finance the deal.

Not sure what Lower Mid-Market means, or other terms used? Download our M&A Terms Pocket Guide.

*Axial is a M&A platform used by many buy-side and sell-side advisors to market and find new opportunities.

My Office Just Burned Down to the Ground – The 6 Documents You Should Store In The Cloud NOW

My Office Just Burned Down to the Ground – The 6 Documents You Should Store In The Cloud NOW