Reading Time: 5 minutes Here are the 8 most common categories of normalizations or EBITDA adjustments, which undoubtedly will increase the value of your company when you sell it.

Normalization Adjustments Are NOT Just Personal ExpensesRead More

// by Linda Rose// Leave a Comment

Reading Time: 5 minutes Here are the 8 most common categories of normalizations or EBITDA adjustments, which undoubtedly will increase the value of your company when you sell it.

Normalization Adjustments Are NOT Just Personal ExpensesRead More

// by Linda Rose

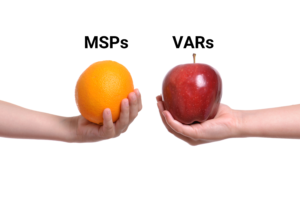

Reading Time: 5 minutes There is a big gap between what a VAR can expect to receive for their company versus an MSP or MSSP with the same net income. Here are reasons why, and how VARS can catch up to MSP multiples.

// by Linda Rose

Reading Time: 4 minutes Here are a few tricks and tips on how to not let your employees, customers, and competitors know that you’re selling your company.

// by Linda Rose

Reading Time: 5 minutes Life after selling your company may not look how you expect, and not having a plan can hold you back. Here are the three most common paths sellers take post-sale, and how to make sure you are ready.

// by Linda Rose

Reading Time: 7 minutes There are a number of ways you can level up your business in 2024 – the question is whether time or money is more important to you right now. Here are some options organized by your priorities.