When I meet people for the first time or have a first phone call, there’s usually some small talk and a little history about their company, and then the owner always asks me “What is my company worth?” Of course, without getting more detailed information about your company, that is a hard question to answer. So, here is generally how I respond to that question.

First, a company’s value is determined by a few major aspects:

- Top Line Revenue and Growth – This is first and foremost. Of course, you cannot compare a $3M company with a $30M company for valuation purposes (the larger the company, the higher the general value). Revenue growth is important as well. Low or no growth, unless during Covid or a recession, is an indication of problems. Otherwise, a growth rate of 10% – 20% per year over the last three years is reasonable and expected by buyers. The higher the revenue, the higher the value. The higher the growth rate, the higher the value.

- Gross Profit Margin (GPM) – Remember, if you are comparing two $5M companies that sell similar products, the one with the higher gross margin is more valuable. Gross margins vary by industry and within an industry; meaning you cannot compare the gross profit margins of an MSP (managed service provider) with an ISV (independent software vendor), for example. I would even say that GPM is more important than bottom line revenue, because general and administrative expenses are fluid and expendable. Of course, in order to properly state gross profit margins, you must accurately account for cost of goods sold, which most people don’t do correctly. Here is a great article that talks about margins and best-in-class percentages.

- Recurring Revenue – The next most important aspect for valuation is the percentage of revenue that is recurring. The higher this number is, the more cash you will receive at close or the shorter the earnout period. In general, companies with over 50% recurring revenue see more offers than companies who have less. It has become a given and norm with all technology companies. But remember: repeat and recurring are two very different types of revenue. While repeat revenue does have value, it is not as highly regarded as recurring contractual revenue. Be sure to understand the difference, and be ready to show each type in your financials.

- Industry Specialization and Intellectual Property – If you have some secret sauce that makes your products and services different than your competition, your multiples will increase dramatically. This is what truly skyrockets multiples. We all know the stories of companies that have no net income but astronomical multiples. The reality is: most people don’t have that strong of an industry specialization, so they try to distinguish themselves in other aspects, (i.e., people, location, experience).

What reduces company value?

Now that you understand what determines value or creates it, let’s talk about the one aspect that will reduce it rather quickly: Customer Concentration!

Recently, I took a very stellar client to market, but had buyer after buyer say “no thanks” because of a high customer concentration with one or two customers. The company had all the aspects listed above, so they should be an ideal seller, but the customer concentration became a real issue.

Here is an example: let’s say that 65% of your revenue comes from billing Amazon for your products or services. You might have multiple projects with Amazon, but as a company in total it amounts to 65% of your total revenue for the year. Of course, no one is going to dispute that Amazon is a great company and will likely not go out of business. It does, however, represent a risk if Amazon decides they don’t want to work with you or don’t need your services going forward. While your company may be incredibly attractive, almost every PE firm will have to back off the deal because they usually wrap debt around a deal, and no lender will be comfortable with that much revenue coming from one customer.

I realize this example is an extreme, but even if you have one or two customers that represent more than 20% of your revenue, it becomes a red flag and reduces the value of your company. Therefore, you really need to watch the customer concentration of revenue. To learn more, I wrote an entire blog on it here.

The good news:

The good news is that every company has the ability to move the needle on their multiples (valuation) by focusing on just these four aspects listed above while avoiding high customer concentration. If all you did for one year was just increase the percentage of recurring revenue and not the actual top line revenue or bottom-line net income, you will have a more valuable company!

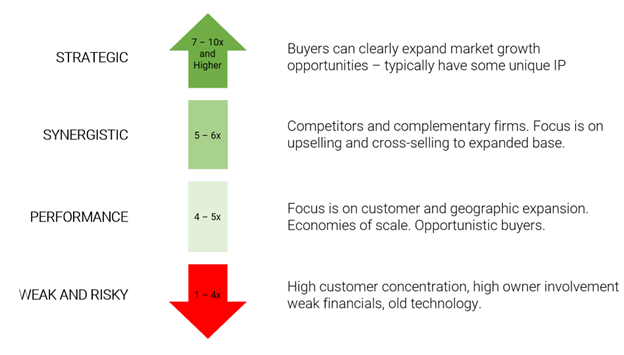

For those who like visuals (that’s me too), here is a very generic visual on multiples that you can actually apply across multiple industries. And while technology companies do have their own set of multiples based on type of service, as mentioned in #2 above, this chart does capture those values as well.

Valuation Overview – Lower Mid-Market

Finally, if you are looking for a more detailed explanation on multiples in the technology services provider area, I highly suggest you check out my book, Get Acquired for Millions. In Part I – Driving From a Desire to a Deal, I go into great detail on multiples in our industry based upon organization type: VAR, CSP, MSP, ISV and developer.

Get Ready to Sell in 2023

Get Ready to Sell in 2023