Working with technology companies as their M&A advisor is a lot of fun. I say that because technology companies have so many more options when it comes time to sell. That is, in part, due to the inherent attribute of recurring revenue and customer stickiness that comes with maintaining your customers’ infrastructure. Other industries don’t necessarily have that automatically built into their business plan. So, when it comes time to sell the company, there are more options in terms of the type of buyer and the structure of the deal.

Here are the top three options I see most IT companies presented with:

- Sell to a strategic competitor, one who uses their own money or obtains a loan from the bank to make the acquisition – so not backed by PE.

- Merge with a complimentary company or competitor who is similar in size so as to attract a larger buyer down the road – a mini roll-up if you will, for a much larger sale to a PE later as a portfolio company.

- Or sell to a larger PE-backed competitor who is already down the path of a roll-up.

Now, before you go on the war path about private equity and how they just want to buy and slash expenses – I should share with you that that is not always the case. Plus, there are some significant up-sides to selling to a PE-backed company, especially if you can roll equity.

Of course, everyone strives for economies of scale when making an acquisition for a roll-up, but no one wants to jeopardize the employees or customers, as we all know you cannot service your customers without loyal employees. So, the smart PE firms approach an acquisition with caution and deference for the employees and customer base, and they try not to rock the boat very much post-sale.

But let’s go back to our three most common options above. Two out of the three can very likely provide for a second cash event after the initial sale of your business: numbers two and three. Yes, it is possible that you can receive equity in the larger company when selling to a strategic competitor, but usually that is not the case. Many times, these strategic buyers buy for personal growth reasons and don’t really plan on sharing any proceeds down the road on their ultimate exit. Plus, there is usually always a component of either seller financing or an earnout.

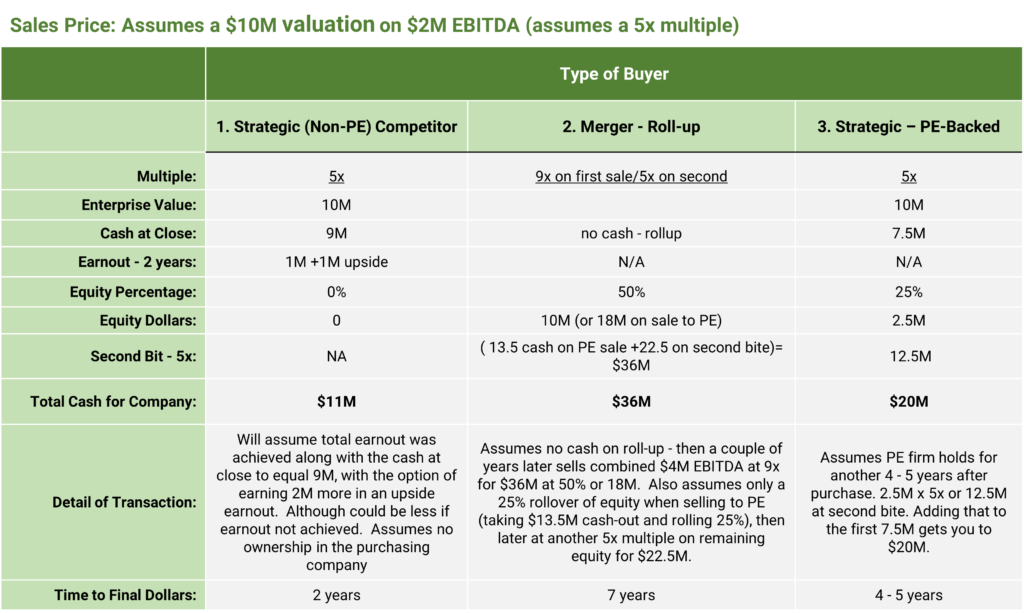

When I present these three scenarios to my sellers, many times they assume that their best offer will come from a strategic buyer – and that may well be true in the short run, but certainly not in the long-run (as you can see by my examples below).

Let’s look at these three different scenarios and really dive into what a second bite of the apple might look like when selling to a PE firm as either a roll-up or a portfolio company.

Here are a few conservative assumptions: Multiples at time of sale or rollover is 5x. Multiples at second bite is also 5x. With the exception of scenario #2 – their multiple at selling the first time to the PE firm is at 9x, since they are now double the size. Don’t get too hung up on the multiples because they stay pretty consistent through each option and a 5x multiple is easy to follow the math.

A Closer Look at Each Option*

Option 1 (Strategic (Non-PE) Competitor):

It is clear that the quickest way to all your money is option one, assuming a two-year earnout. This also works well for companies who are in the sub $1M EBITDA range, companies who just want to cash-out, or those that are willing to accept some seller financing over time. This is perfect for the older seller or even the younger one who just wants to move on to another big opportunity. You will very likely have an opportunity to exit after the earnout, or maybe even before if you have the team in place to execute on it for you. Of course, the downside to this option is that it provides the least amount of cash up-front (most in an earnout) and no additional equity. Now, I am not going to say you will never see equity in the sale to a strategic buyer, but it is unlikely and if you do, you will most likely need to stay on to actually earn it.

Option 3 (Strategic – PE-Backed):

This is a pretty common option among MSPs, MSSPs and CSPs (Cloud Service Providers). So, many PE firms are working the roll-up scenario and are out hunting for add-on’s to their existing portfolio companies. While many PE firms have come down market (meaning a lower EBITDA value), most don’t want to go below $500K. Anything lower than that, and the deal doesn’t make sense due to the legal, accounting, and integration costs associated with every purchase. In most cases, you will be given an option to roll equity; I see ranges from 10% – 25%. If the company is backed by a reputable PE firm that has a track record of successful exits, this can be a great opportunity. As you can see from our example above with a 5x multiple down the road, you can make some nice money on the equity amount you leave in the company. I would be sure to have a lengthy conversation with the PE firm to understand their roll-up strategy, as well as what they expect for multiples down the road. 5x is NOT a number everyone achieves, so be sure to ask what their goal is and how long it will take to get there. One last comment here is that where you are in the rollup lifecycle will also affect how much you have to pay for the stock – so your upside may be much lower than 5x.

Now here is what most people don’t know: you as the seller (or tuck-in to a portfolio company) don’t need to stay for the entire holding period to get the second bite of the apple. Most sellers believe they need to stay the entire time, but you don’t, and you actually may want to move on and retire or build another non-competing company. My final advice on this is: if you can afford to roll the equity, do it. In most cases, it will pay off in 5 years or less and, if it’s structured correctly, it will be all capital gain (remember, I am not giving tax advice here, so check with your CPA).

Option 2 (Merger – Roll-up):

I have saved this for last because it is the most complicated. First, let me tell you how many calls I get from IT services providers who want to pull a few buddies together and sell themselves as a portfolio company. Easy peasy right? No, far from it! While this does have the most rewards, it does take some time and planning. To name just a few things, here is what needs to happen:

- First, you need to create a new entity, and all the smaller companies need to contribute their interests to the new company. Then, you need to begin ACTING as one. This can start simply by moving to one branding strategy.

- Next, define your new organization chart. There should only be one CEO, one COO, etc. Then start mapping out the consolidation of general and admin functions and people. You don’t need three or four people doing the same admin functions, but don’t let them go until you are fully integrated in the next step.

- Next you need to integrate your front and back office. This means all being on the same platform for starters, and then integrating those platforms. The same holds true with accounting. Start by getting aligned on the chart of the accounts, and then begin the combination of the data. And the hard part – as if that wasn’t already hard – is getting everyone on the same contracts and billing schedules. I recommend having this planned out well in advance and before you combine. This process can be difficult and there will be a lot of give and take here.

- Get your adjusted normalized EBITDA to over $2M! More would be better. Ideally $4M if you can get there quickly. The higher the amount, the higher the multiple. This could take up to 4 – 6 companies to accomplish, but it gets harder with any more than that. Plus, you need to do this without using cash; everyone needs to do an equity swap as part of this consolidation. Then, try to grow organically for 6 months (ideally 12) to show the buyer that you can grow as a team.

It’ll probably take 12 to 24 months to do all this and more. If you had just a couple sellers to combine, maybe you could do this in 6 months, but that’s aggressive. Eighteen months to twenty-four months is more realistic, assuming just a few sellers rolling up together. But after you’ve accomplished these steps, you can begin looking for a buyer. And while you are doing that, continue to look for other companies you can acquire, all while acting as one cohesive team.

Needless to say, this is NOT for the faint of heart. But look at the reward above (note, the $36M is just your share at 50% ownership – if you add more companies together initially, this amount will be less of course). Plus, once you are acquired as a portfolio company, there is likely more compensation for you for every additional acquisition you find to add to your portfolio company (hint, remember to negotiate that).

The cohesiveness of the team will have a huge impact on the company’s success in attracting a buyer. If your team is not cohesive, savvy PE firms will see through it and pass. And this process that I briefly outlined above will bring out the challenges of combining (people, infrastructure, agreements, accounting, etc.), which you will need to overcome as a team…and some sellers cannot (for ego or other reasons).

Let me be clear: this option is definitely the long game. Even if you are not taking on the role as CEO, but instead another C-level title, you should plan on staying on for the next 5 years as the PE firm continues to build out the company with other tuck-in’s/add-on’s. I think you will agree that the rewards are worth your time if you pick the right initial group of partners and the right PE firm to grow your company.

Best of luck to you in whatever option you choose.

* Sure, I may be off a little in my assumptions and multiples, but you get the gist and the case I am trying to make: that each option brings a very different result.

Another Transaction Closed…in 23 Days!

Another Transaction Closed…in 23 Days!