It seems like conference season is back in full bloom, doesn’t it? Whether you just attended Directions NA, ITA, ConnectWise Evolve Peer Group, or Robin Robins’ marketing conference, it seems everyone is back to the normal conference pre-COVID routine. Hooray!!!

I just returned from two conferences where margins were a BIG topic (specifically vendor margins), so I thought I would share some thoughts on the topic: specifically, areas that BUYERS focus on when they look at your margins.

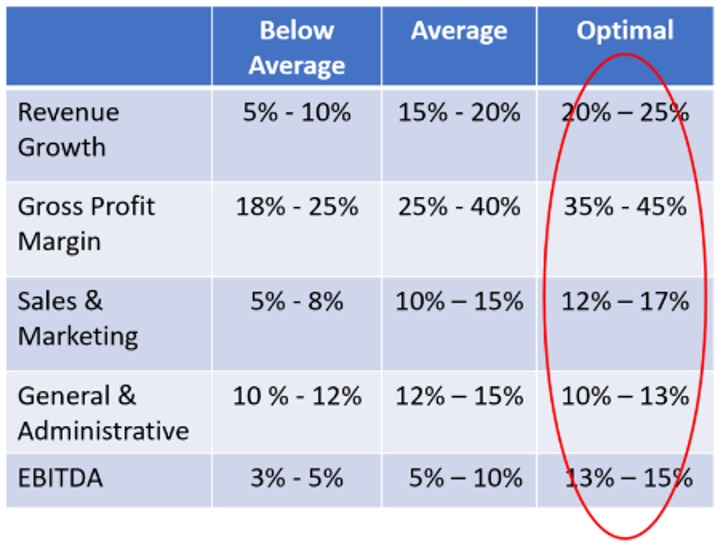

Now, if you’ve been reading my content for awhile, you might recall a blog I wrote in 2019 about gross profit margins and operating percentages needed for a successful practice. If you are new to my blog, you may want to go and read this post because it is pretty insightful on what an “optimal” best-in-class partner should strive for on margins. These optimal margins are still very highly sought-after by both strategic and PE buyers.

But let’s turn our attention for a moment to large vendor margins like Microsoft, NetSuite, Sage, SAP, or other large vendor channels. When it comes time to sell, investors look very closely at these margins and how heavily invested you are with one vendor.

Margin Concentration with One Vendor

While every large vendor would like you to be exclusively selling their products (hint: Microsoft), it actually may work against you, especially as you get larger. Just like we don’t want one large customer representing more than 15% of your revenue, we don’t want all your eggs in one vendor basket either. Sure, it’s hard to support multiple products when you are under $5M in revenue, but once you are well into single or double digits, it’s time to diversify.

Why? If your vendor decides to drop your margins with a 6-month notice or you are not able to keep up with the year-over-year growth expectations of your vendor, this could dramatically affect your bottom line and overall company valuation.

Here is a perfect example: NetSuite (NS) renewals range from 30% down to 5%, depending on a look back of your last six- or twelve-month performance. So, if you are having an “off” half of a year, your margins could drop as much as 25% on upcoming renewals. That’s a huge hit to the bottom line, and savvy buyers will dig deep into those partner agreements during due diligence so they know exactly what an off period might do to your bottom line. Now, of course, I am picking on NS here, but other channels do this as well, albeit maybe not as drastically. The point is that once you are north of $8M, if not sooner, you need to diversify your vendor base to protect your valuation and your bottom line.

What If You Can Only Support One Vendor?

Representing multiple solutions for large software applications such as an ERP or CRM solution can be daunting, I get it. And if you have a small team, it can become out of the question to pick up another major application. However, I think a better option might be to pick up a complimentary solution to one you are already offering. Let’s say, for example, a budgeting application to go along with your ERP solution or a marketing automation package that might link to the CRM solution you are supporting. While these may not be relevant examples to your exact business, you get the point: find something complimentary where you can use your existing skillset to easily add on another solution. I see many of these “add-on” solutions offering the same or better margins, which will clearly help the bottom line and the valuation when it comes time to sell. Think “high value/high margins” when you are running through your analysis and deciding what you might want to push as a secondary or tertiary product.

Shop Your Margins

For those of you who purchase indirectly via a large distributor like Ingram, TD SYNNEX, Sherweb, Softchoice, etc., think about shopping your margins. You will be surprised at the latitude these distributors have when reselling. They, of course, are getting the top margin from the vendor, but if you put forward your goals with them for the year, they may increase the current margin level you are receiving. And while 2% – 4% doesn’t seem like much, it can add up over time. Most resellers just assume what they are getting is the norm, when it’s not! So be proactive and shop those margins.

Rebates That Add Up

While rebates cannot be counted on every year, they are a normal part of doing business with a channel vendor. Almost every successful MSP, MSSP, or VAR that has been in a channel long enough knows how to sniff out or apply for a good rebate. Last year, I had a client with a salesperson who was so good at asking for rebates that it became a significant number (credit) to their cost of goods sold section on their P&L. Because the number was so high (over 5% of the revenue for the current year), the buyer wanted to subtract it as part of the normalized income, but we argued heavily towards keeping it. Because the salesperson routinely demonstrated, year after year, a track record of harvesting significant rebates, it was considered as a revenue line item for the company! Again, tiny amounts can certainly add up, and they go directly to the bottom line, so be sure to ask your vendors and distributors what quarterly rebates are available and how you can earn them.

Conclusion

Most resellers don’t spend the time to look at margins or seek out an opportunity for improvement…until it comes time to sell, and at that point it might be too little too late. Treat vendor margins a little like good customers: here today, but possibly gone tomorrow because of changes unrelated to you or your business. Do what you can to fiercely protect or increase your margins by seeking out complimentary high impact/high margin applications and not putting all your trust in just one vendor or distributor. And always, always understand your true downside should you not meet your vendors’ revenue expectations. Find ways to mitigate a potential drop in margins and have that plan ready should a buyer ask.

Top Three Options When Selling Your Company: Strategic Sale, Merger and Roll-up to Private Equity

Top Three Options When Selling Your Company: Strategic Sale, Merger and Roll-up to Private Equity