The question of WHEN during the year is the optimal time to look for buyers is a common one. This question comes up especially often this time of year. Around the beginning of the fourth quarter, most sellers have good visibility to their year-end numbers, or at least better than they did a quarter ago. And, if the results are positive, it then prompts them to want to take action and possibly get a deal done by the end of the year. So, I get the calls from prospective sellers asking me if I can find them a buyer and possible close by year-end.

Well, I hate to be the bearer of bad news, but unless you have been in deep discussions with a prospective seller to this point (meaning you have given them sufficient data for them to issue an LOI), then the answer is, “Probably not.”

According to my recent conversation with Peter Conzola, Business Development at Staple Street Capital, as well as other Private Equity firms and strategic buyers, the fourth quarter is all about getting what is in the pipeline closed. Unfortunately, there is very little bandwidth to look at new deals. So, if you don’t have a buyer already interested, this is probably the worst time of year to go to market.

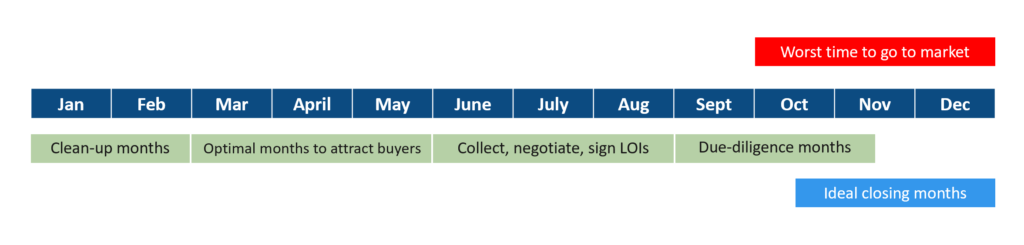

Let me explain the ideal buying timeline using this timeline below:

A typical acquisition timeline

First off, M&A does follow a calendar year for the most part. Most strategic and financial buyers operate on a calendar year-end, and also like to close deals by year-end if possible.

The beginning of the year for most active buyers is about cleaning up after the year-end close rush or finalizing those deals that couldn’t get done for one reason or the other. Year-end analysis and planning also take up these couple of months.

Late February through May become the ideal months when buyers are out looking for their current year deals. This is when they have the most time and are on the hunt. So, this is ideally when you want to have your data room stocked with the initial items needed for an LOI.

June through August is when you can expect a lot of initial review, conversations, and preparation of IOIs and LOIs by active buyers. It is important to be early in this process as all buyers have their limits on the amount of deal flow they can handle during a calendar year. Going to market in the summer months is not out of the question, but it does put you in a line with earlier prospective acquisitions. If your transaction is not large or not as “strategic” as the others they are looking at, you may get passed up purely for bandwidth reasons. This is more common now as M&A is at an all-time high. I have had more than one buyer need to pass on one of my sellers due to bandwidth reasons.

As we can see from the chart above, most active buyers are heavy into due diligence in the fall. Many like to get their larger targets completed prior to Thanksgiving. Almost all deals will take a pause of about two weeks to account for the Thanksgiving and winter holidays. Legal counsel and advisors like to take time and NOT be in the middle of a deal if possible, so this “time-off” is built into their closing schedules.

Approaching a buyer for the first time in the fall usually means you are behind one of two other deals and you probably won’t get the mindshare or eyeballs needed (unless, of course, they haven’t found a target company). Remember, M&A is as much about timing as it is about finding the right buyer. Therefore, I would say this is the worst time of year to go to market (i.e. to begin the process of attracting buyers via a buyer outreach done by either yourself or an M&A advisor).

Now there are exceptions to all of this. Case in point: I advised a deal where an LOI was signed on the 15th of November and the deal closed on December 31st. But that is extremely rare, and the buyer and seller had been speaking for many months prior. Also, if two companies are very close and know one another well, a deal may get stuck in the beginning of the fourth quarter with a targeted year-end close. This is exactly how one of my own companies was sold. We knew our buyer fairly well and had begun preliminary discussion (no exchange of data until August) which then allowed for a year-end close.

Of course, even the ideal transaction planning can go awry, and I occasionally will get a call in September or October from active buyers still looking to fund something before year-end, but again, that is rare.

It is always important for anyone contemplating a sale to have an actively updated virtual data room and to have an attorney pre-selected should a last-minute opportunity arise. Both of these can be very time consuming and stall a year-end deal.

Waiting and planning is a better approach

Unless there is a very compelling reason to get a deal this year (e.g.. change in tax rates), you can begin your planning now by interviewing and selecting your ideal three advisors: legal, accounting, and M&A. Negotiate those agreements and terms and then begin stocking your data room with items that don’t change from one year to the next: IC Agreements, MSA’s, Vendor Agreements, and possibly your HR Manual as examples. Then you will be in the perfect position to use the first quarter of the next year to finalize all your prior years numbers and populate your data room with all the necessary items. This will put you in the optimal position to go to market early spring, and give you the time to vet multiple buyers, select your ideal buyer, and negotiate your ideal terms.

Looking for what you should prepare in advance? Download our “IT Pre-Due Diligence Checklist.”

Bumps in the Road…. After the Letter of Intent is Signed

Bumps in the Road…. After the Letter of Intent is Signed