If you’ve been following me for a while, you know I often say that the majority of my transactions use an F Reorganization. To be precise, it’s closer to 99%. Why? Because this quiet, behind-the-scenes structure is one of the most seller-friendly tools in all of M&A. It doesn’t make headlines, but it can make the difference between a deal that flows smoothly and one that bogs down in endless contract renegotiations.

And here’s the kicker: even many seasoned buyers don’t know this option exists. They’ll sit across the table and tell you, “We only do asset deals,” without realizing that there’s a clean, well-established mechanism in the tax code that gives them exactly what they want while saving the seller an enormous amount of pain.

Why Buyers Push for Asset Deals

If you’ve sold a business, or even just had exploratory conversations with buyers, you’ve probably heard the refrain: “We only do asset purchases.” What they usually mean is that they want two things:

- To avoid taking on any hidden or unrecorded liabilities from the company.

- To get a tax basis step-up so they can amortize or depreciate assets and reduce their taxable income going forward.

Those are legitimate concerns. But the problem with a straight asset purchase is that it forces the seller to re-paper almost every relationship the business has built: every customer contract, every vendor agreement, and often every employee file. If you’ve ever tried to push dozens (or hundreds) of stakeholders through a fresh round of paperwork in the middle of an acquisition, you know how quickly the deal can turn into chaos.

Employees may decide this is the perfect time to renegotiate their salaries. Customers may ask for discounts or special treatment before they’ll sign. Vendors may delay or, worse, use the moment to tweak terms in their favor. Suddenly, instead of celebrating a closing, you’re bogged down in contract purgatory.

The F Reorg Solution

Here’s where an F Reorganization comes in. When properly structured, it lets the buyer get the protections and economics of an asset deal while allowing the seller to keep the same operating entity intact. That means most contracts, licenses, partner IDs, payroll systems, and day-to-day operations just keep humming along. From the outside, almost nothing changes.

You avoid the nightmare of redoing hundreds of agreements, and the buyer still gets the liability protection and tax advantages they were looking for. It really is the best of both worlds.

Who Actually Does the Work

One of the most common misconceptions I hear is that this structure somehow creates more work for the seller. The reality is that the seller’s attorney handles the entire process.

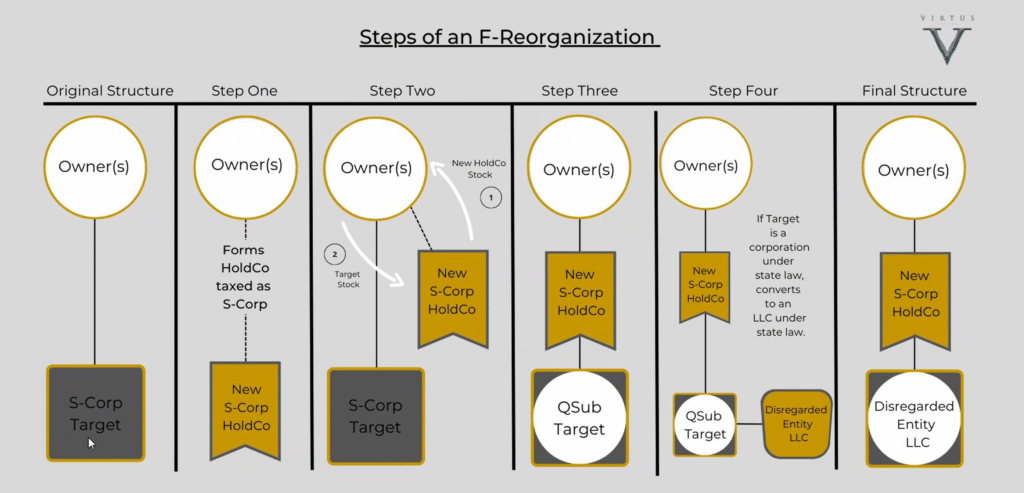

Here’s what typically happens:

- A new holding company is formed.

- The appropriate tax elections are made, often in coordination with your CPA.

- The operating company becomes a disregarded entity under the holding structure.

That’s it. To the outside world, your EIN, your payroll, your customer contracts, and your vendor agreements all stay put. The only thing that changes is the ownership structure above the operating company. Here is a quick visual:

It’s important, though, to have an attorney who has done this before, ideally in your home state. Each state has its nuances, and you want someone who knows how to navigate them. Your attorney will ensure that the entity receiving proceeds (whether that’s cash at close, earn-outs, or equity rollovers) has been properly set up and filed.

For you, the seller, this usually feels like a few days of quiet paperwork in the background. You keep running the business, and your advisors handle the mechanics.

Why This Matters Right Now

The current M&A market is cautious. Buyers are under pressure to justify valuations. Financing costs are higher. Due diligence feels more intense than ever. Sellers, meanwhile, want to get to closing without rattling employees or customers.

An F Reorg bridges those needs. It gives the buyer the structure they’re comfortable with while giving the seller continuity. Deals don’t stall out in never-ending contract reviews, and the business isn’t forced into the spotlight before the ink is even dry.

And here’s something that still surprises me: many sophisticated buyers simply don’t know about this structure. They default to “asset purchase only” because that’s what they’ve always been told, or what their last deal looked like. I can’t tell you how many times I’ve had to push the conversation back to the table: “Have you considered an F Reorganization here?”

Once buyers loop in their counsel and tax advisors, they almost always come around. It’s in everyone’s interest to keep the process simple, and most reasonable buyers recognize that once the mechanics are explained.

Real-World Impact

Let me give you a few examples of the benefits of an F Reorganization:

- Managed Service Providers (MSPs): Without an F Reorg, a straight asset deal would mean re-papering every single client contract, often with hundreds of small businesses that don’t move quickly. With an F Reorg, those MSAs and SOWs stay with the operating entity, uninterrupted. The transition is invisible to clients, which means the recurring revenue stream the buyer values so highly doesn’t skip a beat.

- Microsoft Channel Partners: CSP designations, co-op funds, and partner IDs are notoriously difficult to transfer. An F Reorg helps preserve those relationships and credentials without triggering a reset in the Microsoft ecosystem.

- VARs and ISVs: Reseller authorizations and distributor credit lines can take months to renegotiate. An F Reorg keeps those intact, so product flow and margin programs continue without disruption.

In each of these cases, the alternative (i.e., redoing every agreement) would have slowed or even killed the deal. But with this structure, you can quietly close a transaction, and the rest of your world doesn’t even need to know.

The Bottom Line

As a seller, you don’t need to master every nuance of the tax code or the legal steps involved in an F Reorganization. That’s what your attorney and CPA are there for. What you do need to know is that there is a well-established, IRS-sanctioned path to give buyers the asset-like protections they demand while sparing yourself the pain of renegotiating every relationship in your business.

It’s one of the most seller-friendly tools in M&A. And if you’re serious about selling your company, it’s worth bringing this up early in the process…especially if the buyer starts with “we only do asset deals.”

Your attorney handles the paperwork. Your contracts stay intact. And your deal is far more likely to close smoothly, with employees, customers, and vendors none the wiser until the time is right.

That’s the quiet power of an F Reorg.

12 Hidden Landmines in LOIs (And How to Defuse Them)

12 Hidden Landmines in LOIs (And How to Defuse Them)