In my last post, I discuss in some detail the difference between an asset and a stock sale, as well as the advantages and disadvantages of each. Whether you are an “S” or “C” corporation, a stock sale has the advantage of allowing for mostly, if not all, capital gain rates on the sale of the company. Given that long-term capital gain rates are still at the rates of 0%, 15%, or 20%, depending on a combination of your taxable income and marital status, it is well below the ordinary rates, which can be as high as 37% for income over $647,850 (married filing joint). Therefore, you want to structure your transaction to allow for as much capital gain as possible, which would be a stock sale.*

For many reasons discussed in my prior post, most acquisitions made by strategic buyers are asset purchases, so an F Reorganization is not likely an option since equity will not be shared down the road. But private equity is a different story; they do want to give sellers equity, as well as try their best to minimize the tax consequences to the seller.

That said, sellers don’t always get the option of making that decision, because the buyer really would prefer an asset purchase for the step up in tax basis that it provides. But even if the buyer wanted to extend a stock purchase to the seller, it may not be possible due the seller’s corporate structure (i.e., an S-corporation), which limits the number and types of shareholders. Since S-corporations are the most predominate type of corporation for closely held businesses, this can pose a problem, especially for private equity buyers who want to extend equity to the seller while eliminating ordinary gain later on. That is where an F Reorganization comes to the rescue**.

Basically, an F Reorganization is a tool that allows for a stock sale to be treated as an asset purchase by the buyer, plus has the added benefits of allowing for the seller to keep all future income components to be treated as a stock sale AND allows for the FEIN of the selling organization to be taken over by the new buyer. That last added benefit simplifies so many things, like employee contracts, payroll taxes, benefit plans, customer contracts, etc. ***

Sure, these may eventually be incorporated into the new owner’s company, but it doesn’t have to. Or, it can be done at a later date once all other post-acquisition integration is completed. Therefore, if you are being viewed as an add-on acquisition by a PE firm, this is a perfect solution to maintain your current identity and not lose it as part of the sales transaction. This is hugely important for companies who have significant brand identity. Instead of losing your name as part of the acquisition, you retain your name, but become part of the new company. For Example: OLDCo, an ABC company (ABC Company being the acquiring company). You retain your logo, your URL, etc., while the acquiring PE firm goes about its business of building the portfolio.

Now that we understand why you might proceed with an F Reorganization, let’s get into what the structure looks like.

How an F Reorganization Works

In practice, F Reorganizations typically involve S corporations, either as a target in an acquisition or as the acquiring entity. The pass-through tax treatment of an S corporation is attractive, but limits on who can be shareholders and being limited to having a single class of stock can create obstacles to retaining pass-through tax treatment for business operations.

One common way of completing an F Reorganization is through the creation of a new corporation, which initially becomes the parent holding company of a new entity that will operate the existing business. The parent holding company then sells part or all of its interest in the new entity.

Let’s look at this step by step:

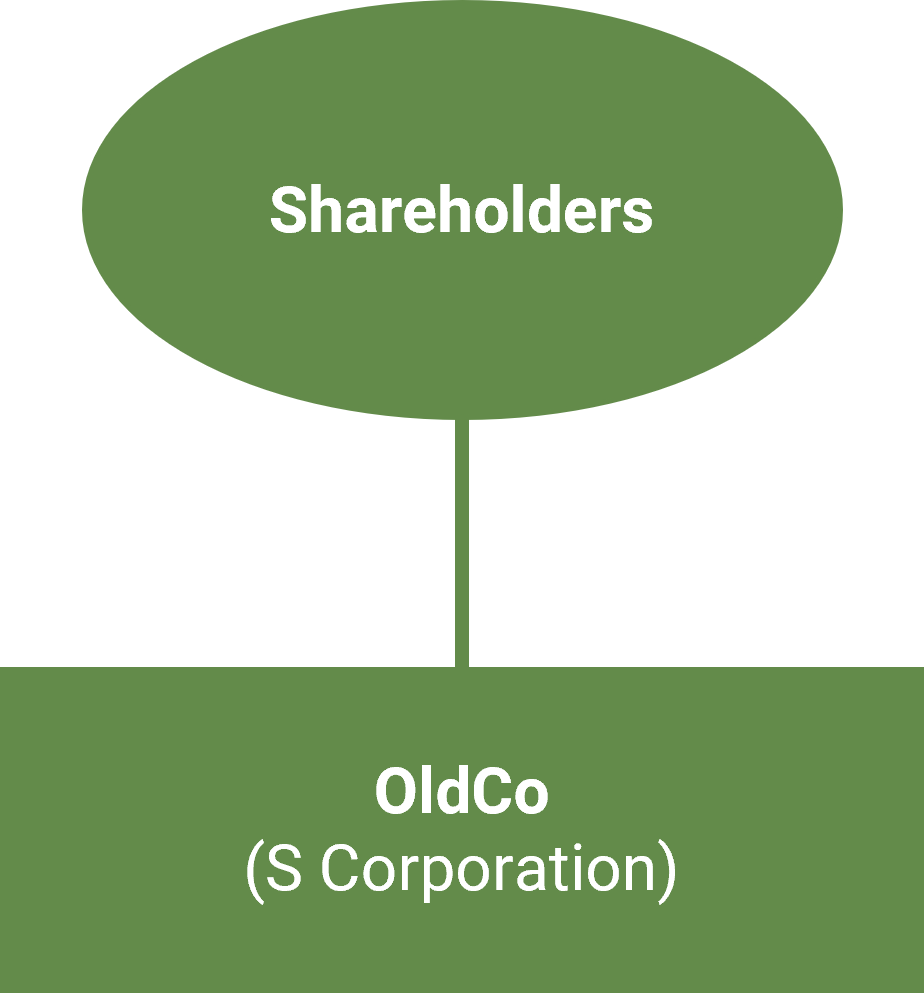

First let’s start with the current structure: current shareholders own all of the issued and outstanding shares of the existing company (“OldCo”).

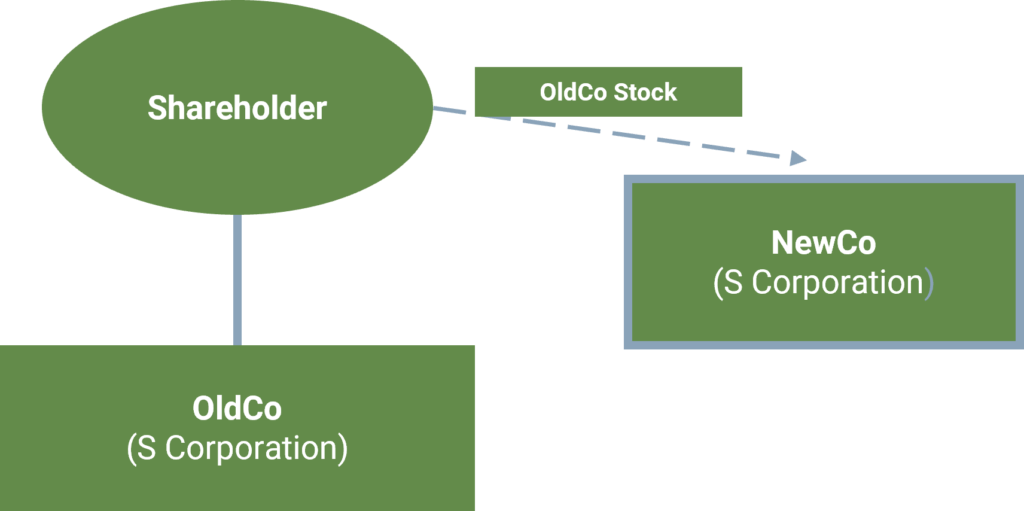

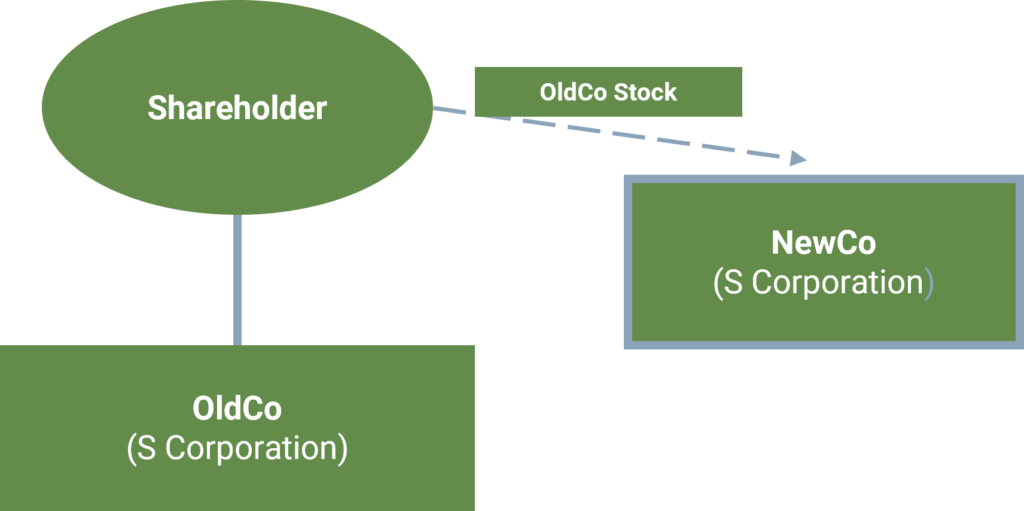

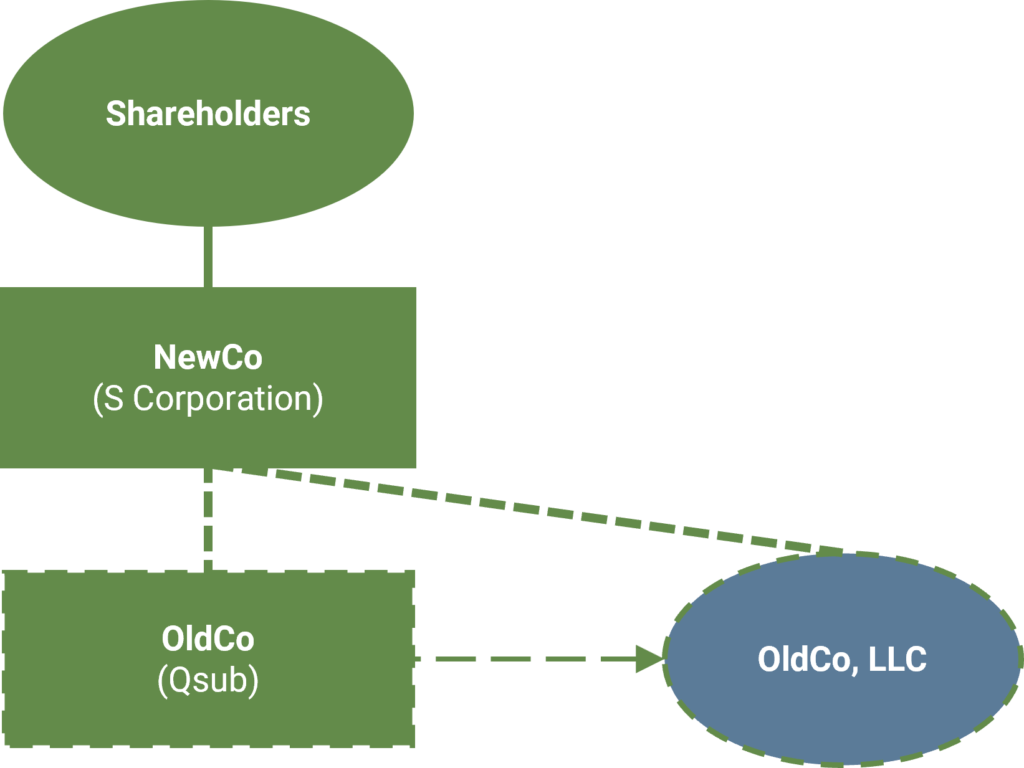

Step 1: Prior to the sale of the company (7-10 days), your counsel forms a new entity called NewCo (for our example), which might be in a different state than where you are currently incorporated.

Step 2: All of your current shareholders contribute their shares of OldCo into NewCo in exchange for all the shares of NewCo (also an S-corporation).

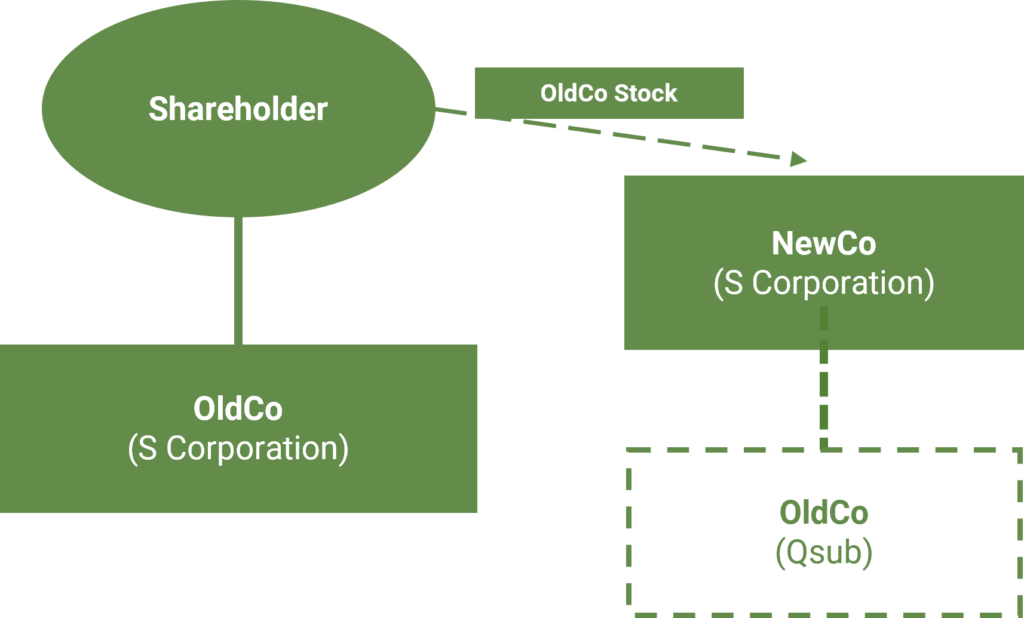

Step 3: NewCo then elects to treat OldCo as a qualified subchapter S subsidiary (“Qsub”), which basically allows you to do a tax-free transfer or liquidation of assets into the new company. Keeping all this tax-free is important at this stage.

Step 4: OldCo now converts from a Qsub into a limited liability company and merges with the newly formed LLC subsidiary of NewCo.

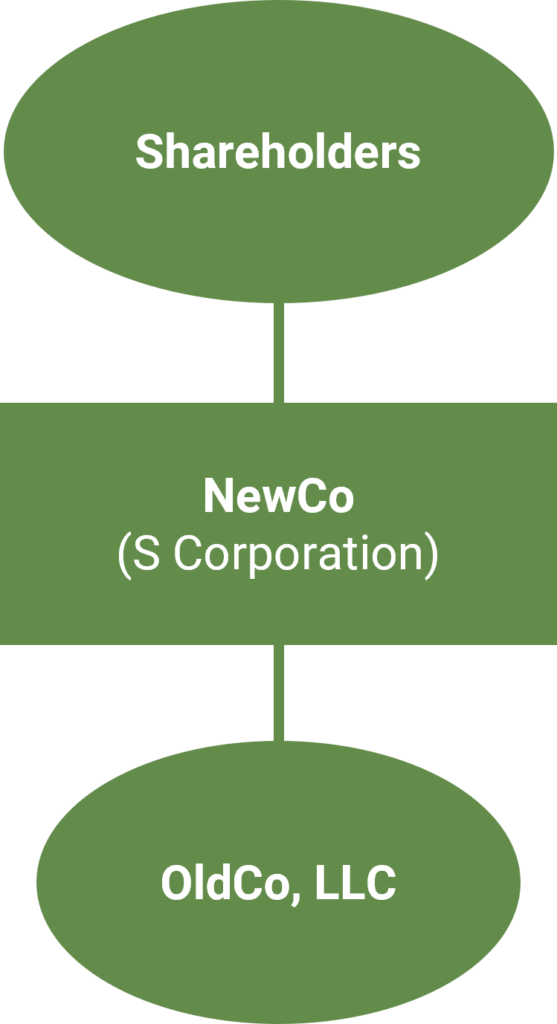

After the transaction-reorganization is completed, all shareholders of OldCo have the same number of shares in NewCo.

After all this pre-transaction restructuring for the original S-corp is completed via the F Reorg, there are now multiple options for a buyer to proceed with the acquisition of the assets of the newly formed entity. (1)

The timing and nuances to getting all this done in the right order require both the buyer’s and the seller’s counsel to work together. Both legal teams really need to know how to work this out, otherwise it because an exceedingly difficult exercise with frustrations on both ends.

Conclusion

Many private-equity transactions are structured as an equity purchase rather than as a direct asset purchase. Sellers often prefer a stock sale because they expect to receive preferential capital gain treatment on any resulting gain. At the same time, buyers generally prefer not to buy stock, since they do not receive a step-up in the tax basis of the corporation’s assets. An “F” reorganization, named after IRS Code Section 368(a)(1)(F), allows this transaction to happen without any tax consequences to the seller as part of the reorganization. It also allows for future income from the sale to be taxed as capital gains rather than ordinary. It allows the buyer to become a shareholder of the newly formed company and also allows for the transfer of the FEIN from the seller to the buyer in the newly formed entity.

* If the seller made an acquisition in the last twelve months, there may be a situation where you will have to recognize ordinary income on the assets you purchased.

** You may also have heard of the election under IRC Code Sections 338 under Sec. 338(h)(10) or Sec. 336(e), which is another mechanism that provides a buyer of corporate stock the convenience of a stock purchase with the tax benefits of an asset acquisition; however, each election has its own requirements and limitations. Not only might it require coordination between the buyer and the seller with respect to the election and various other legal matters, but also sellers cannot achieve a tax deferral on any rollover portion of the transaction, which is generally a norm in these private-equity transactions where buyers want sellers to have “skin in the game” for some percentage of the post-close business. This code section also does NOT allow for the FEIN to be transferred between the buyer and the seller.

*** Remember I am not your tax advisor nor am I giving legal advice. This topic is very complex, and you should seek both a CPA and legal counsel to fully understand the ins and outs of an F reorganization.

I do want to thank the team at Virtus Law for reviewing this post to make sure I covered this correctly at a high level. My clients have successfully completed F reorganization transactions with the help of Virtus Law.

Asset vs Stock Deal – Which is right for you?

Asset vs Stock Deal – Which is right for you?