Normally I stay as far away from politics as I can, but I do need to address the elephant in the room, and the question most sellers are concerned about which is CAPITAL GAINS and the likelihood that they will increase under the Biden administration, or more immediately in 2021.

Afterall, an increase in the capital gain rate from 15% – 20% to something much larger does have a significant impact on how much money you keep after taxes. Also, at the top of minds of many sellers is the possible increases in the corporate tax rates under President-elect Joe Biden, which will mean less to the bottom line in future years. This could spur owners who were “thinking” about selling in the next few years, to actually “acting” upon those thoughts.

This year, however, the prospect of possible tax increases under a new Democratic administration are more complicated.

Nearly a month after the election, it remains unclear whether Biden will have the benefit of passing tax legislation with a Democratic-controlled Senate, or whether Republicans will maintain control of the chamber. The answer will have to wait until Jan. 5, when two runoff elections for both of Georgia’s seats will settle the Senate’s last undecided races. This leaves sellers in a precarious spot. Biden’s tax plan would raise the corporate rate from 21% to 28%, and long-term capital gains which are currently taxed around 15% – 20% (see table below) would instead be taxed as regular ordinary income. Increasing the corporate rate could limit companies’ free cash flow, hindering the ability of firms to strike deals during Biden’s presidency.

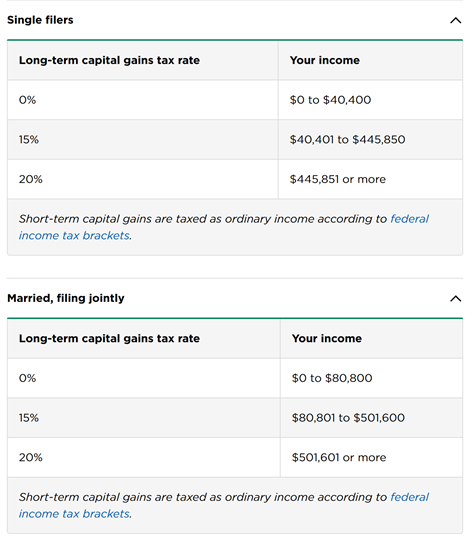

2020 Long-Term* Capital Gain Rates

* Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. The long-term capital gains tax rate is 0%, 15% or 20% depending on your taxable income and filing status. They are generally lower than short-term capital gains tax rates. Most sales of companies are subject to mostly long-term capital gains vs short-term gains.

But actually passing that tax plan is far from certain in a Senate that Republicans still lead 50-48.

The Senate would only flip blue if Democratic challengers Jon Ossoff and Raphael Warnock can prevail over incumbents David Perdue and Kelly Loeffler, respectively. A 50-50 split means Democrats have the edge, with Vice President-elect Kamala Harris serving as the tie-breaking vote.

Given this late determination of who will control the senate, any tax measures that pass may not even go into effect until near the end of 2021. (See chart below for current 2021 Long-term Capital Gain rates).

My feeling is it will take the administration nine months to a year to the get the new legislation written in, and then it may still take until 2022 before a change in the tax rate might become effective.

But here is the reality, tax effects don’t typically happen mid-year, and can be done retroactively. So, even if the Biden administration does decide to change the capital gain rate (assuming they win the Senate), it is possible, but unlikely that they will make a capital gain tax change mid-year, (due to the complexities it would create in tax forms). However, it is possible they could make it retroactive back to 2021 in 2022, but I think that is unlikely. Again, this is just my opinion and nothing more.

Here is the reality: If you can still get a transaction completed this year, then do it! For the rest of you contemplating a transaction on the horizon, you might want to consider starting and finishing the deal in 2021, just to be safe.

Now the disclaimer…even though I am still a registered CPA, I am not giving out tax advice and suggest you seek the advice of a practicing CPA to discuss your personal tax situation.

To be continued….on January 6th, or whenever we can count all the votes a second time.

When is the “Right” Time to Sell Your Company?

When is the “Right” Time to Sell Your Company?