Like I have said many times before in my blogs, a picture paints a thousand words.

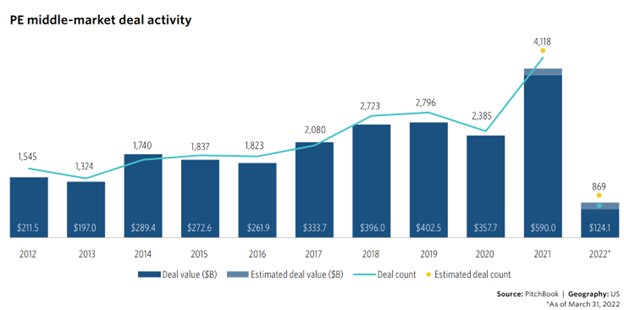

After a historic dealmaking pace in 2021, US middle-market private equity (PE) firms got off to a modest start. While both deal count and value decreased by around 40% compared to the records set in Q4 2021, deal activity is still in line with that of previous quarters (remember, we are only looking at a quarter in the graph below, compared to an entire year of 2021).

But the big question to ask is, “How will this continue, given the increasing interest rates?”

Well, that depends…let me digress for a second. I just returned home from a week-long whirlwind tour of Montana (potentially looking for a new second home), where home prices have sky-rocketed during the pandemic like everywhere else. Even more so there, I believe, due in part to the popular series Yellowstone. Honestly, its crazy!

It seems everyone (not just me) wants that open space, “big sky” cowboy life-style and is heading to Montana. California, apparently, has contributed more than 13K to population growth in Montana alone since the start of the pandemic. Again, that’s just Californians.

While I am seeing home prices starting to drop in other parts of the country due do increasing interest rates, they are not dropping that dramatically in Montana! And neither are the valuations for IT companies in the lower mid-market. But terms are starting to change.

The Trends in IT Deal Activity

IT deal activity remained strong in the first quarter of 2022, accounting for 15.2% of middle market deal value in Q1, despite several economic headwinds. Even though some tech stocks traded much lower as the public market took a hit during this second quarter, PE appetite for IT has remained largely unaffected. Capital still flowed into the sector, with 110 deals closed at an aggregate of $13.5 billion. Investors remained focused on companies with attractive growth prospects. Many investors believe they can still drive returns in this sector if the companies they purchase can out-pace any fall in valuations. (1)

PE firms are, however, adjusting to the current market environment by pursuing smaller tuck-in or add-on companies with lower valuations; that’s good news for those of you under $20M or so in revenue. Companies that provide solutions in business and productivity software, offering much-needed solutions for smaller organizations looking to improve their digital capabilities, are also preferred over expensive enterprise solutions.

Hello … that includes all of you who are selling mid-market ERP/CRM and other productivity software.

Those of you who are MSPs/MSSPs/Cybersecurity consultants will also continue to maintain high valuations due to the continued threat of security breaches; kind of like homes in Montana who have views of the Bridger, Tobacco Root, or Gallatin Mountains, that will continue to hold their value due to the next season of Yellowstone being filmed.

While we have not yet seen an adverse impact on deal activity across the general IT sector, rates are certainly top of mind, as we know that all PE firms (including those strategic buyers backed by PE) use debt to leverage their deals. Rising interest rates can adversely affect valuations of existing holdings, as well as the ability to finance new acquisitions. Since the aftermath of the global financial crisis (GFC) in 2008 and 2009, the PE industry (which is mostly who is buying up larger and smaller IT firms) has matured, and most believe the industry is better prepared to face any potential economic downturn.

What to Expect as a Seller

So, what does this all mean to you, other than home prices are still high in Montana? The market is still hot for IT firms, especially those with over 40% recurring revenue and those who focus in cybersecurity. While I have not seen prices drop, I have seen terms extend out a bit longer (yes, back to two+ years earnout, and slightly less cash up front). Cash remains king, and the preservation of it for as long as possible is important. That may mean less cash up front, a seller-note, or a larger chunk allocated to an earnout if the ARR is not high (greater than 40%). For now, that is where I think we will see the biggest changes – good news for those of you worried about valuations!

How long this trend will last? That’s anyone’s guess. At some point, you have to wonder: as interest rates continue to rise (and they will), will investments take a pause? Will cash at close continue to drop? I guess we are back to that crystal ball I don’t have. When exactly is the right time to sell or buy?!

I am at least hoping the increased interest rates will lower home prices so I can start shopping in Montana again…regardless of how popular my favorite cowboy, Kevin Costner in Yellowstone, remains.

(1) Pitchbook Q1 2022 Middle Market Report: https://pitchbook.com/news/reports/q1-2022-us-pe-middle-market-report?utm_term=&utm_campaign=etr_market_update&utm_medium=newsletter&utm_source=daily_pitch&utm_content=q1_2022_us_pe_middle_market_report

The Unsolicited Offer – Three Do’s and Don’ts You Should Know

The Unsolicited Offer – Three Do’s and Don’ts You Should Know