2022 has been another great ride for M&A in the technology sector, but what does 2023 bring?

Think about it. In just one year, we have experienced:

- The war in Ukraine, where our supply chains have been disrupted at the source, in transit, and at destination.

- Inflation closing out 2022 with a 6.5% annual reading, as measured by the consumer price index, down from 9.1% in June.

- The Federal Open Market Committee voting to boost the borrowing rate AGAIN by half a percentage point, taking it to a targeted range between 4.25% and 4.5% (remember, it started out at .25% in March of 2022).

- Along with the increase came an indication that officials expect to keep rates higher through next year, with no reductions until 2024.

However, despite the headlines, buyers are remaining optimistic, especially in the IT sector. While there is optimism, I did see a lot more caution in the due diligence process, with buyers double-checking the quality of revenue (recurring or repeat), the quality of the customers (longevity), and the quality of the management team (tenure) to help steer them through uncertain times. With companies possessing all of these traits in short supply, many buyers expect multiples to be maintained, despite some of the economic conditions listed above.

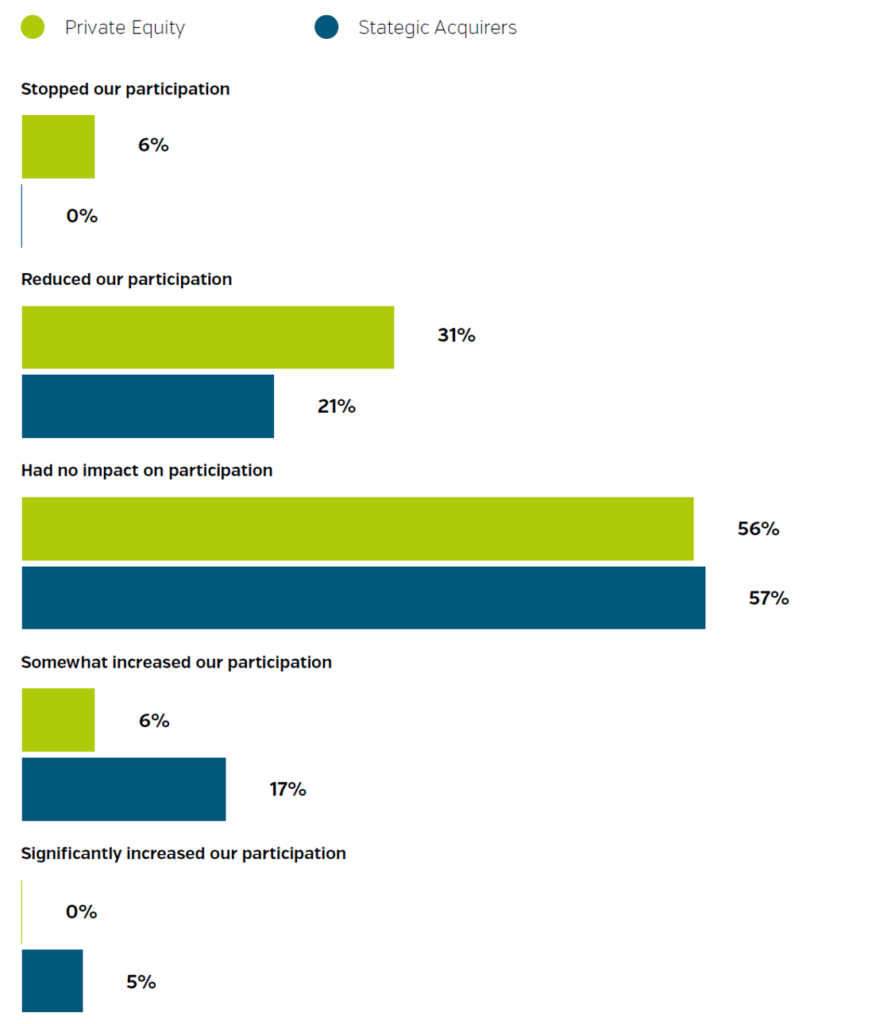

Take a look at the graph below showing buyer perspectives on the current economic situation, from Equiteq’s Global Buyers Report for 2023.

Overall, while some buyers have had to adjust their plans, with around a quarter saying the economic situation has reduced their activity, the majority are saying that the current economic situation has had no impact on their M&A plans.

What do you think the net impact is, if any, on M&A plans given the current economic situation?

Lower Valuations Can Be Expected – Caution in the Air

While M&A isn’t expected to let up in 2023, our experience closing four transactions during the final quarter of 2022 indicated that buyers want to continue to deploy capital, but only if the right conditions exist. We did, however, see valuations drop slightly, especially with companies who rely heavily on one or two vendors. The feeling amongst buyers is that large vendors such as Microsoft, Oracle, Amazon, and IBM will continue to squeeze margins from their partner channels. And those partners who rely heavily on one vendor specifically are at a greater risk for valuation deterioration should their vendor reduce margins.

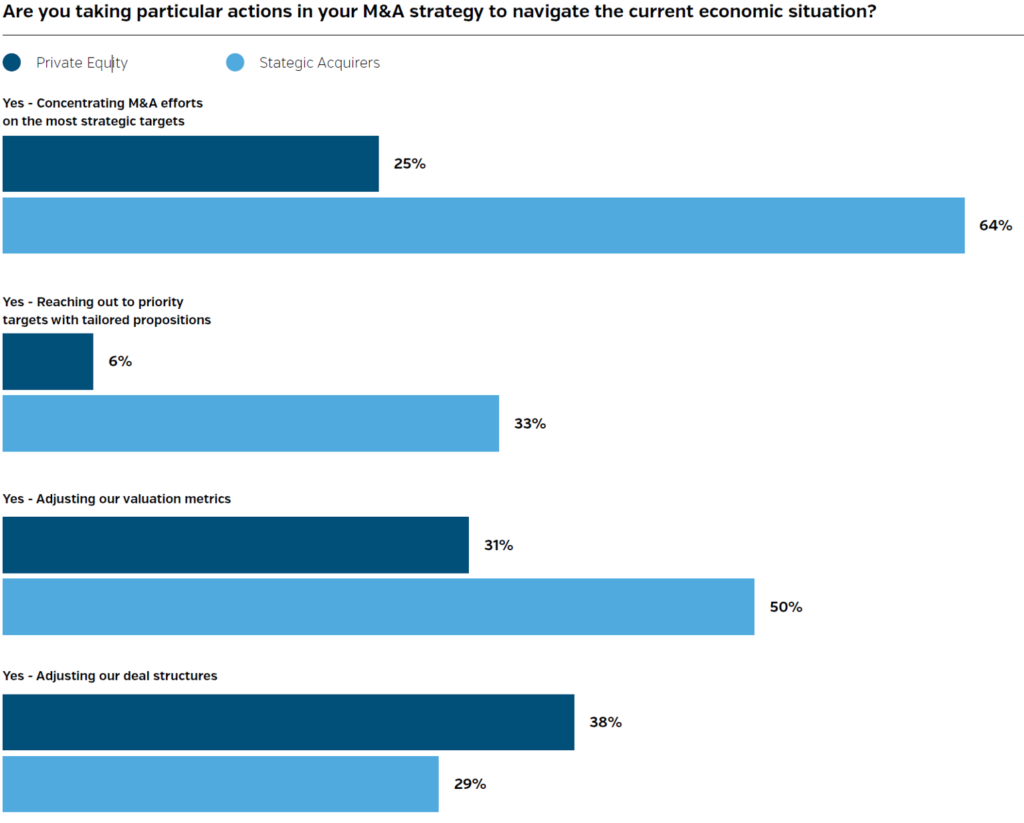

Also on the valuation front, per the Equiteq Global Buyers Report: they are seeing some Strategic and Private Equity buyers adjusting their valuation metrics downward (regardless of vendor concentration) to navigate the current economic situation. In this case, it is mostly Strategic buyers that are taking corrective action, primarily by adjusting valuation metrics [50%] and deal structure [29%], and refocusing their efforts on the most strategically aligned targets.

In the Private Equity world, cautious optimism still exists as there is still an abundance of capital (dry powder), but they don’t want to be reckless in deploying it. Whereas with Strategic buyers, this is not the case; these buyers don’t want to take on large amounts of debt or stretch themselves when it comes to cash flows to buy companies at astronomical valuations.

One Word of Caution

If you know me and have read my content, you probably know by now that I am all about transparency. The reason, in part, that I got into M&A advisory consulting is because I felt that many advisors were just in it to make a profit and didn’t really help their clients succeed in the process of selling their companies – more on that in another post.

That said, while I had a great year, here is my word of caution… I recently found myself in a national conference session with other M&A colleagues sharing how well last year went and discussing M&A and what 2023 might look like. Most of my peers want sellers to believe that valuations are NOT changing, because the deals they were completing (which started in early 2022 and are now closing) locked in some nice multiples before all the economic changes I mentioned above hit the market. So, this statement about valuations was made based on deals forged earlier in 2022, NOT TODAY.

My Conclusion

Here is the reality: with interest rates up 4% year over year, there is no way that valuations don’t change. They have to, unless the acquisition is being made without debt (which happens, but is rare) or the PE firm has a line of debt that has locked in interest rates at 2022 values for 2023 (also rare, but possible). Strategic buyers and even Private Equity, with their vast amounts of dry capital, continue to use debt to fund acquisitions, so valuations must change to fund that debt.

Here is another reality: those companies with a high amount of recurring revenue, strong gross profit margins, a diverse customer base, and a strong management team behind it will always receive the best offers from buyers who will continue to make acquisitions in 2023 and beyond. Demand for IT services remains high as companies continue their journey in digital transformation, and human capital continues to be harder and harder to find. So, regardless of interest rates and the world economy, my feeling (along with most of the rest of the buyers survey above) is that M&A will remain strong in 2023. Make the most of it!

Common M&A Agreements

Common M&A Agreements