While I have sold two separate technology firms in my career I will focus on the most recent which involved a business broker. I will share my experiences on timing, when to start, when not to start, and how long the process will take. The time between making a decision to sell and finding a broker could take as a little as a week, but most people need more time to process the thought of selling everything, so I cannot speak to how long that might take for you, but for me it took a month to make the mental decision to sell. That said, I had been conversing with brokers for 8 months prior to educate myself on the process, valuations and just how each broker worked. (Probably the same reasons why you are reading this post.) Once I got comfortable with whom my business broker was, from there the process from start to signing the final paperwork with the buyers took 8 months. We lost a month over the holidays, but I went into the holiday season already knowing who my potential buyers would be. My first business was sold in half the time; four months instead of eight, so personally I think 100 days is a little too quick. Below is how the 8 months broke down on my most recent transaction:

While I have sold two separate technology firms in my career I will focus on the most recent which involved a business broker. I will share my experiences on timing, when to start, when not to start, and how long the process will take. The time between making a decision to sell and finding a broker could take as a little as a week, but most people need more time to process the thought of selling everything, so I cannot speak to how long that might take for you, but for me it took a month to make the mental decision to sell. That said, I had been conversing with brokers for 8 months prior to educate myself on the process, valuations and just how each broker worked. (Probably the same reasons why you are reading this post.) Once I got comfortable with whom my business broker was, from there the process from start to signing the final paperwork with the buyers took 8 months. We lost a month over the holidays, but I went into the holiday season already knowing who my potential buyers would be. My first business was sold in half the time; four months instead of eight, so personally I think 100 days is a little too quick. Below is how the 8 months broke down on my most recent transaction:

Month 1 – The first month was about getting comfortable with a profile that I truly felt highlighted my strengths and could be easily articulated to buyers. This included me pulling a number of financial data points together: last 5 years earnings with EBITDA, geographic reach of client base, revenue by type (recurring and non-recurring), churn rate and vertical markets we served. More on EBITDA in Part III. This process may be easier for some then others depending on well you manage your financials.

Month 2-3 – Reviewing NDA’s from potential buyers. This truly was the fun part! I was really pleasantly surprised at the broad reach of buyers my business broker knew and worked with in the technology industry and revenue size. Within a short 4 – 5 weeks they had built a tremendous list of interested buyers who wanted to take the next step with an NDA. Our broker handled this process nicely for us with up-to-date info on where we were with every opportunity. Once a NDA was signed their team would set up the phone calls with potential buyers. I was truly pleased with the number of people interested in getting into the Microsoft space and who were interested in my company; all for different reasons, but many buyers seemed interested in coupling their existing portfolio/company with a complimentary business such as ours.

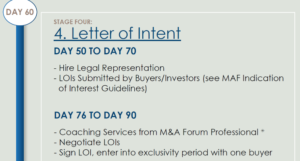

Month 4 –During this month we narrowed our selection down to three great opportunities, then narrowed down to two. This process was based mostly upon fit both organizationally and culturally as well as the earn-out period each buyer was looking for. Having a good fit after the deal was done was very important to me. After a number of calls and a site visit I signed the Letter of Intent (LOI) with my primary choice, which in this case required no earn-out period (unusual, but not unheard of). Once the LOI is signed you usually have to cease looking/shopping, so be sure that is who you want to continue with, otherwise you can lose a good few months if that turns out not the be the right company for you. Also, now is the time to make sure you have counsel in place that can see you through the rest of the process. Hopefully your years in business has given you an opportunity to get comfortable with a legal firm (or individual). Good legal counsel is so important, so if you don’t have someone now that you can trust to see you through this, start getting references from others.

Month 5 – Taking a break over the holidays – well at least with activities but not mentally or emotionally. You can see a finish line but you are not there just yet. Here is a good time to share my thoughts on timing; Don’t start the process right before the holidays – people are usually looking to get deals signed by year end, and if not then at least they already know who will close by Q1. If you have not begun the process by October, then wait until January to begin – but that will begin slowly as people are still wrapping up last year’s deals and need a little breather.

Month 6, 7, 8 – Lots of legal back and forth. What I thought could be accomplished in 30 days, clearly took 90! We ended up with three separate agreements; Purchase/Sale, Non-Compete, and Transition Services, all with their own amount of legalese to wade through. These last three months were where I felt my business broker really was invaluable. I rarely spoke to the buyers (by choice) instead voicing any issues through my broker and my attorney. Needless to say, any transaction of this magnitude will have some back and forth that may tax even the most patient of people. “Deal fatigue” is common, emotions can run high, so it is best to stay healthy and balanced during this process. Your management team will be critical at this point (assuming you have let them in on the pending transaction). My CFO and CIO were very involved in the due diligence requests and were key in the final scrutiny of the documents. I made sure that key personnel were taken care of as part of the transaction so they too were motivated to get the deal to the finish line.

And then it’s done! You’re in a little shell-shock first. You realize you just sold your second child, but you quickly move into the great “transition” phase.