With a plethora of data and surveys out in the marketplace regarding the economy and how the Coronavirus will affect the stock market and future company valuations, it’s hard to really understand how this will impact technology partners, after all, most surveys are not targeted to channel partners. Ernst & Young published a survey last week of 2,900 global executives which found that 73 percent of respondents expect the COVID-19 outbreak to severely undermine the economy. The survey also showed uncertainty about when the market will recover. Some 54 percent of respondents anticipate a more gradual recovery on a U-shaped curve after a longer slowdown that will extend into 2021.

But how about technology partners? You know, the ones who are providing some of the key services needed to keep the economy running? How will Coronavirus effect our valuations and how long must we wait until we can return to January 2020 valuation peaks?

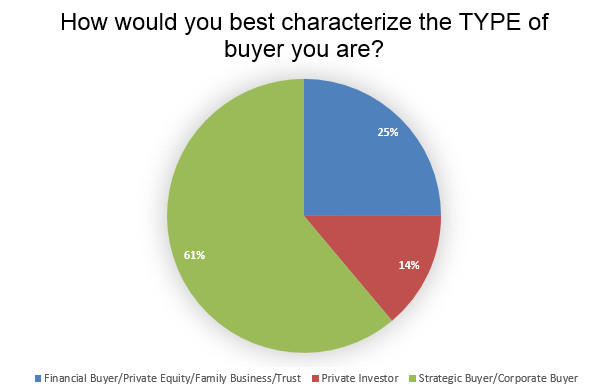

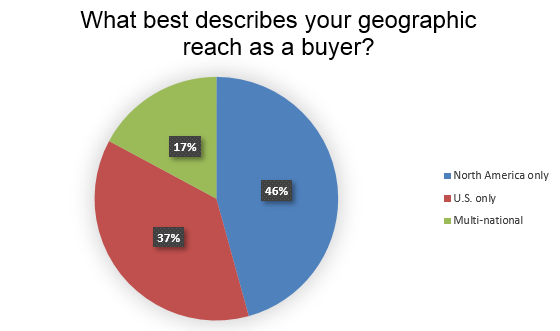

We ran a survey from March 22 to April 15 specifically targeted toward buyers of technology service providers in the lower mid-market ( i.e. VARs, MSPs, ISVs, CSPs, SIs and custom developers under $100M in revenue) to ask them specifically how this current environment will affect deals going forward: namely – timing, valuation and deal structure. The majority of our survey respondents are Strategic or Corporate Buyers, meaning those already in the technology space who own similar companies. It is worth noting that when we viewed the responses by buyer “type” we saw similar patterns, so all buyer types were basically in agreement.

We also wanted this survey to be specific to North America as the Coronavirus length and implications could be viewed differently by other countries.

While the survey population is much smaller (sub 100 participants), we analyzed these results along with our own personal experience of completing two transactions of Microsoft partners during this same time period. Here is what we found.

Current transactions in process

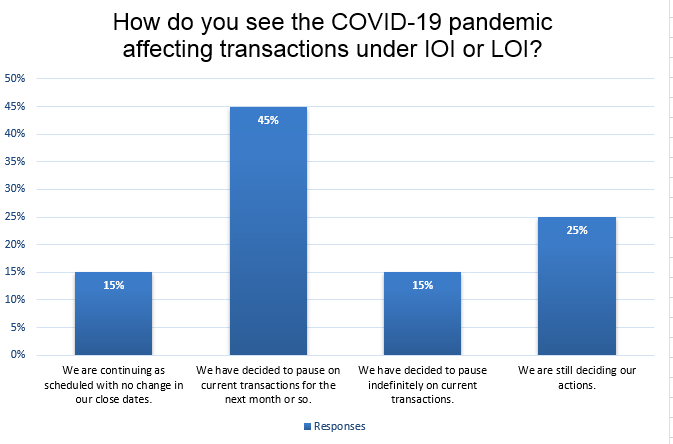

Many companies are currently under a LOI or IOI at the time of this outbreak and, depending upon the strength of the customer base and the pipeline, those factors really determine whether the transaction will continue or not. Those partners who focus on an industry whose customers are greatly affected, i.e. airlines, travel industry, entertainment, and food service, are putting those transactions on hold or terminating them altogether. (This is probably a time when being vertical in one of the many hard-hit industries might not serve you well.) However, those partners that have a strong and diverse customer base and that have solid pipelines of contracted future services or a high percentage of monthly recurring revenue are continuing on in the acquisition process.

Survey comment…

MSPs should end up pretty strong after COVID-19, depending on their verticals.

There are many technology partners who are able to take advantage of the current work-at-home requirements and increase their sales considerably, specifically MSPs, CSPs and those offering transition to the cloud from on-premise ERP services. Of the three active transactions I have been advising during the last four weeks, two have closed and one was canceled, but then a new buyer stepped in. So it’s not all doom and gloom, deals are still closing and still for 100 percent cash at close. In general, however, here were the responses of our buyers to our survey:

Future Buyer Acquisition Plans and Structure

Unlike the recession of 2008, cash is still available, and debt remains cheap. So almost no buyer we spoke with views this virus to be as dire as the last recession. Private equity is still sitting on $3T+ in cash they need to invest. Strategic buyers still have plenty of cash, and there are still record low interest rates. Will deal structures change slightly? I believe they will, as even those buyers with cash will want to conserve as much as possible since no one really knows how long it will take for us to get back to normal.

Survey comment…

Buyers with committed capital will likely continue to acquire, whereas buyers without committed capital will likely put things on pause.

Prior to this virus outbreak, sellers could expect as much as 65 percent upfront and 35 percent in an earnout. When a seller note is involved, we typically saw 40 percent cash, 30 percent note and 30 percent earn-out. Partners looking to sell their companies without a large (over 50 percent) amount of recurring revenue can expect a change in terms for some time, but not necessarily valuations.

What this means for the majority of sellers in the market for the foreseeable future is that there will likely be less cash up front and more allocated either to a seller note or earn-out. For those buyers really concerned about the future, there will be a greater percentage of the transaction terms pushed to the earn-out, and with extended periods. But again, these parameters are dependent on the strength of the company and the amount of recurring revenue the seller produces. The more secure (recurring) the revenue, the higher the amount of cash upfront.

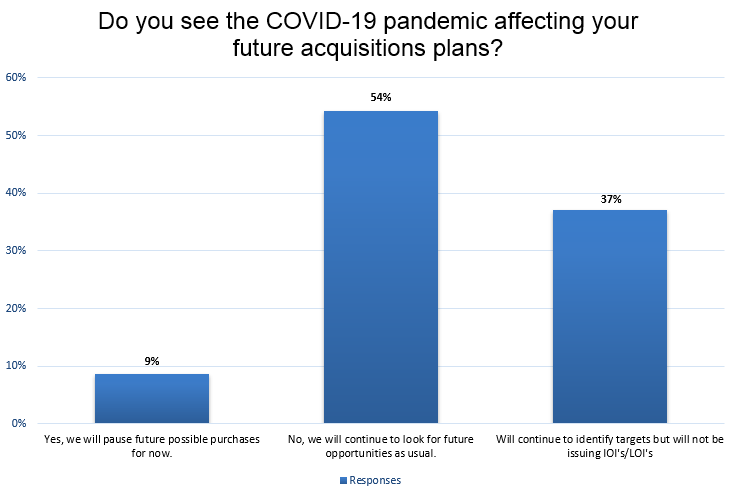

From our survey we saw again that only 9 percent of buyers were hitting the pause button on searching for future purchases, with the majority of buyers (54 percent) continuing to look for sellers.

Valuations Going Forward

Like the 2008 recession, this will be a test for many as to the strength of what they have built. For MSPs, especially those that have been growing at the pace of the economy and with very thin net operating margins, this may be a very difficult time. But for those that have built a resilient recurring revenue stream, they will only get stronger. If there ever was a time for pushing your cloud solutions, it’s now. While pure Private Equity groups and Family Offices may hit pause for a bit to assess their portfolios, competition for the really strong businesses will drive valuation multiples up for those lucky few.

Survey comment…

Covid will cause the stop of all companies who survived just above the bankruptcy threshold without excelling. The free spaces left by these companies that will not survive this crisis will be a conquest ground for well-structured companies. Being able to acquirethese [weaker] companies by providing them with the financial resources to conquer these new market spaces is an opportunity that is unlikely to be repeated in the short term and which could increase the return on investment.

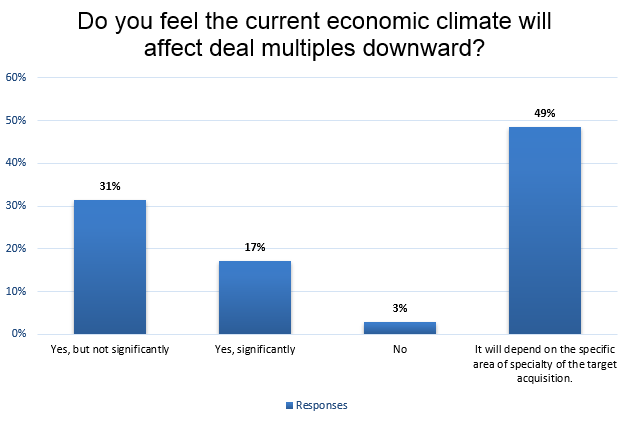

According to our survey, deal multiples will vary depending on your area of specialty. Clearly if your vertical is hospitality or travel, now is not the time to enter the marketplace if you can avoid it. But as you can see from the survey results, multiples are really going to be viewed on a deal-by-deal basis, with only 17 percent of buyers seeing a significant drop in deal multiples. And to the contrary, if your company is staying on pace or even exceeding projections, you are sure to attract more buyers which typically drives up valuations.

What are the best next steps?

If you are looking to grow through acquisition, there will be more opportunities available to you in the form of struggling companies that will just not make it on their own and will welcome the opportunity to become part of a larger infrastructure and team. This can be a great opportunity to increase your customer base (both numbers and geographically) and access to some very talented consultants and engineers by making some quick acquisitions for little money up front.

Survey comment…

Liquidity may drive opportunities, and also the psychological impact of owners seeing a material impact in sales and liquidity. I think more deals will come to market in the next 6 months.

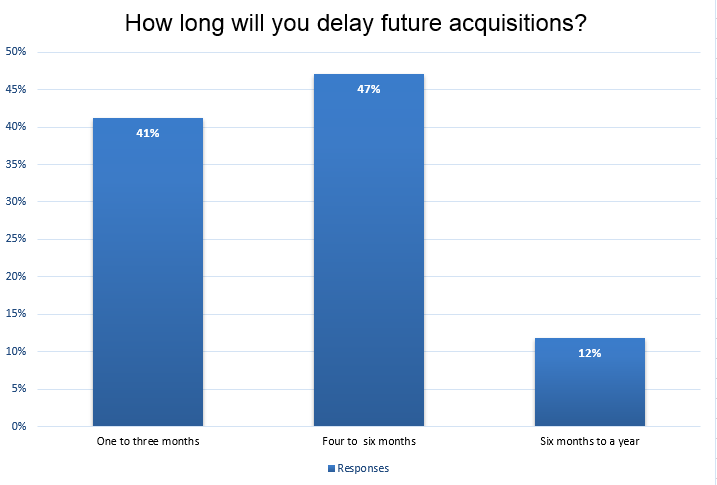

For those looking to sell and who continue to remain strong financially, the window to prepare your company for an exit is small, with 41% of buyers taking a short pause of only 1 – 3 months. Repeat buyers have a process and will continue to acquire strong companies, meaning the strongest, most-prepared companies who come to the market first will get more attention. Smaller or one-time buyers will take a longer pause and wait for things to normalize.

For those still building their companies, this unprecedented time is probably already showing you where you might have weaknesses, like in your customer base, your offerings, or both. Or you may not have the right people in the organization to weather this storm. It should also be showing you which of your lines of revenue will remain resilient and profitable. Either way, it will give you some insights that might not have been so apparent prior to this unprecedented time: insights that can make your company more valuable when it’s your time to exit.

Whichever direction you head, use the time wisely; M&A will become an attractive route for those who have done well during this period and can show that they have transformed their companies and can thrive in an entirely remote scenario; both from their product offerings as well as remote-worker arrangements. This pause will be over before you know it, and buyers most assuredly will want to make up for lost time.

Want to learn how we can help?

Kraft MS Dynamics ERP Practice Gets Acquired with Help from RoseBiz M&A Advisor Services

Kraft MS Dynamics ERP Practice Gets Acquired with Help from RoseBiz M&A Advisor Services