Editor’s note: This post was originally published in 2024 and has been fully updated to reflect the 2025 changes introduced by the One Big Beautiful Bill Act.

If you are a C corp owner who is considering selling your company, there is a big tax update that you should be aware of.

I’m talking about substantial changes to the Qualified Small Business Stock (QSBS) Gains Exclusion under Internal Revenue Code Section 1202.

I personally took advantage of this tax loophole for federal tax purposes when I sold my last company (I unfortunately was not in one of the states that accepts it). But now, it has just received its biggest updates in more than a decade through the One Big Beautiful Bill Act (OBBBA).

Let’s walk through what QSBS is, which companies qualify, what’s changed, and key action steps for IT and SaaS business owners.

What is QSBS and Internal Revenue Code Section 1202?

QSBS refers to stock issued by a U.S. C corporation (regular company form – not an S corp) that meets certain requirements. Under Section 1202, when both the company and the shareholder satisfy the rules, the shareholder may exclude from federal income tax up to 100% of the gain when they sell the stock. In other words: business owners of a qualifying small company can achieve tax-free profits of tens of millions of dollars. The key here is that it MUST be a stock sale (not an asset sale and not an F-reorganization).

Which Companies Qualify for the QSBS Gains Exclusion?

Here are the key eligibility rules:

- The issuing company must be a U.S. C corp. (An LLC that has elected to be taxed as a C corporation is eligible.)

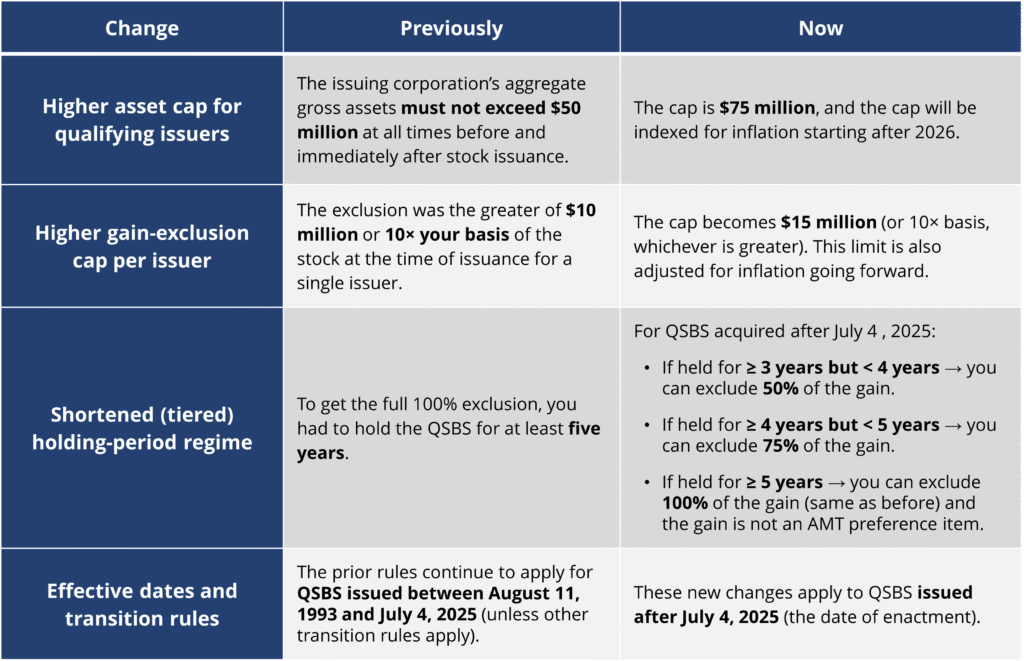

- It must be a “qualified small business.” This traditionally meant aggregate gross assets of $50 million or less (before and immediately after issuance), but under OBBBA, that threshold has been raised to $75 million (with inflation indexing).

- The company must be engaged in an active trade or business, and certain industries are excluded. For example: finance, insurance, farming, many professional services (law, accounting, consulting), hospitality, etc. Technology companies ARE eligible.

- The stock must be held directly or indirectly by an eligible shareholder (individuals, trusts, and estates). So, yes, you are safe if you decide to put your company into a family trust. Partnerships and other S corporations can be eligible, but it gets trickier.

- The shareholder must meet the holding-period requirements and issuance date requirements (more on this later).

- The stock must be acquired at original issuance (not a secondary purchase) from the company. But it doesn’t have to be issued as part of the original incorporation. For example, stock received as compensation for services provided to the corporation meets this requirement, even if issued years after incorporation.

For IT companies, SaaS businesses, MSPs, and other tech services firms, the “small business” threshold raise is likely to bring more companies into the eligible QSBS zone. If your company has grown, raised capital, or is close to that threshold, this change matters.

Capital Gains Exclusions for Stock Issued Before July 4, 2025

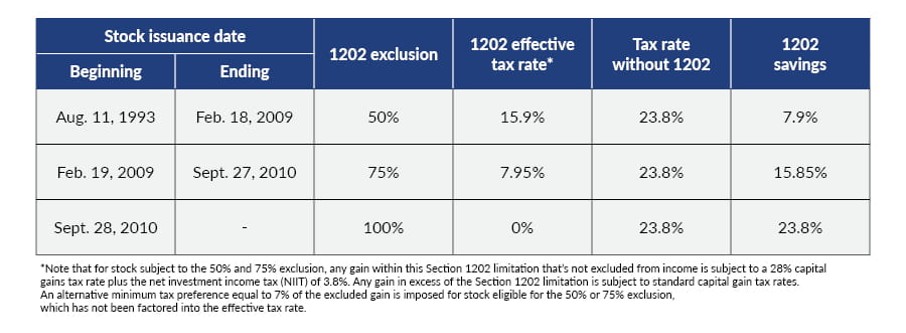

It’s important to note that the new changes to Section 1202 are only effective for stock issued after July 4, 2025. For stock issued between August 11, 1993, and July 4, 2025, prior rules apply. These rules allow a capital gain exclusion on the greater of $10 million or 10 times the aggregate adjusted basis of the qualifying stock at the time of issuance, so long as that stock was held for at least 5 years. The percentage of exclusion depends on the date the stock was issued. Here is a handy table that breaks it down based on your stock issuance date

Don’t remember what you paid for your stock? Look at the capital stock value section of your balance sheet and take your percentage share. For example, if you issued 10,000 shares at $1 per share (and you are 100% shareholder), you will likely see $10,000 in capital stock. Taking that $10,000 times 10 equals $100,000. Since you can take the greater of that amount or $10M in capital gains exclusions, you would take the $10M.

What’s New Under the One Big Beautiful Bill Act

Here are the major changes that the OBBBA has made to the QSBS Gains Exclusion rules.

Example (Adapted to the New Rules)

Suppose you invest $100,000 in QSBS shares of a U.S. C corp that qualifies under the new rules (i.e., issuance after July 4 , 2025, company under $75M assets, you meet all other rules). You hold the shares for 4 years and then sell them for $1.1 million in Year 5.

- Your gain = $1.1 million minus your $100,000 basis = $1 million.

- Under the tiered holding period rule (≥ 4 yrs but < 5 yrs) you get a 75% exclusion of your gain → so you exclude $750,000 and pay tax (at ordinary or capital gains rate) on only $250,000.

- If, instead, you waited the full 5 years or more, you could exclude 100% of the gain (i.e., the entire $1 million might be tax-free).

This is a simplified example, but it illustrates the impact of the new rules.

What If My Stock Was Issued Before July 4, 2025?

Let’s say you’re a founder who has owned stock in your company for years (or at least since before the July 4, 2025 effective date). Will these changes affect you at all?

One area where these new rules could potentially make a difference for you is if you rollover equity into a buyer that qualifies for QSBS treatment. Keep in mind that this requires that you receive new stock in a C corp whose aggregate gross assets are $75M or less at the time of issuance. But if those conditions are met and you hold the stock for at least 3 years before a recapitalization event, you could qualify for the new rules.

And if you’re still years out from selling and have been thinking of changing to a C corp from a different structure, now would be a good time to do so, as the new rules will apply to the newly-issued stock.

States that Follow the QSBS Rule

Some of you will be fortunate enough to live in a state that conforms with Section 1202, allowing you to exclude the gain for state tax purposes as well. Below is a visual of each state and how they are treated.

Many times, I do get asked the question, “Can a seller move to a different state (i.e., Texas) to avoid the state capital gains tax?” I personally looked into this as well, being a California resident where the maximum tax rate is 13.3% for revenue over $2M for married filing jointly or $1M for single filers. And through my research and review of case studies, California would find a way to claw back my revenue, even though I might have moved to a different state before the sale. So, it’s wise to check with your tax advisor if that is something you are contemplating.

Key Action Steps for IT and SaaS Business Owners

- Check your company’s issuance date: Was the stock issued after July 4 , 2025? If yes, the upgraded rules apply; if no, the older rules apply (though those are still generous).

- Confirm your company’s aggregate assets: Does your company fall under the $75M cap at the relevant times? Document this.

- Track your basis, holding start date and stock type: Ensure your QSBS was acquired at original issuance and you hold it for the required period.

- Plan your exit timing: With the 3-year and 4-year exclusion tiers now available, you may have more flexibility in your exit horizon.

- Document industry/activity eligibility: Ensure your company is in a qualifying business (tech/services companies often are but professional services may be excluded).

- Consult your tax advisor: Given the interplay of QSBS with other tax rules (AMT, state tax, employment tax, and option exercise rules), get professional advice tailored to your situation. And do this now, as you may need to do some planning to take advantage of this.

Final Thoughts

The QSBS Gains Exclusion under Section 1202 has long been one of the most effective tax-planning tools for founders preparing for a company sale. With the changes introduced by the One Big Beautiful Bill Act, the benefits are now broader (more companies qualify), faster (tiered holding periods), and larger (higher cap).

If you’re in the IT, SaaS, MSP, or services/tech world and you own or are about to acquire equity in a C corp, this is a moment worth serious attention. The key is to not only be aware of these benefits, but be ready to capture them by aligning your company structure, timing, documentation, and exit plan.

If you want to learn more about QSBS, here is a great website that also has a calculator: https://www.qsbsexpert.com/qsbs-basics/

As always, I am not giving tax advice, so be sure to check with your tax professional, or consider upgrading your tax professional if you don’t feel like they can handle the sale of your company. After all, it may be a once-in-a-lifetime transaction.

Normalization Adjustments Are NOT Just Personal Expenses

Normalization Adjustments Are NOT Just Personal Expenses